Public sector stocks witnessed higher volatility during the week.

News in Focus

Motilal Oswal has issued a BUY recommendation on UTI Asset Management Company (UTI AMC), projecting a 23% upside with a target price of Rs 1,250.

The Royal Challengers Bengaluru (RCB) square off against Chennai Super Kings (CSK) in what could be the final on-field meeting between Indian cricket icons Virat Kohli and MS Dhoni.

In its latest research update, Motilal Oswal has maintained a Neutral stance on Bajaj Finance Ltd (BAF), assigning a target price of Rs 10,000—an upside of about 10% from the current market price o

Emkay Global Financial Services has maintained its BUY call on Vedanta Limited, adjusting the target price downward to Rs 525 from Rs 550, reflecting a 25% potenti

Ambuja Cement Limited has emerged as a frontrunner in India’s cement sector, bolstered by robust quarterly performance, margin expansion, and ambitious cost-reduction targets.

Main Regional Stories

JSW Infrastructure, the logistics and port development arm of the JSW Group, continues to chart an ambitious growth trajectory.

In its latest research coverage, Motilal Oswal has reiterated a BUY rating on CEAT Ltd., assigning a revised target price of Rs 3,818, indicating a 15% upside from the current levels.

The global online gambling giant bet365 is reportedly evaluating a major strategic pivot that could reshape the landscape of the digital betting industry.

MGM Resorts International posted an impressive operational performance in the first quarter of 2025, marked by record-setting achievements on the Las Vegas Strip, despite a marginal decline in consolidated net revenues.

TopNews Arab Emirates

- UAE’s Sharaf Group Announces Rs 5,000 Crore Investment in Kerala

- Dubai Introduces 3D-Printed Solar-Powered Rail Bus for Urban Mobility

- Dubai’s Sky Palace: The Ultimate Luxury Penthouse Listed for $51 Million

- Noida International Airport to Start Flights for Dubai, Singapore, Zurich, Brussels and Munich

- Abu Dhabi Airports Achieves Record Passenger Growth in 2024

TopNews Hindi

- पीएनबी हाउसिंग फाइनेंस (PNB Housing Share) के दमदार Q4 प्रदर्शन से निवेशकों में उत्साह

- मारुति सुजुकी Maruti Suzuki Share पर “BUY” रेटिंग, लक्ष्य मूल्य Rs 14,001: प्रभुदास लीलाधर

- IREDA के शेयरों में 1.14 प्रतिशत की गिरावट; टियर-2 बॉन्ड से Rs. 910 करोड़ जुटाए

- जीएमआर एयरपोर्ट्स (GMR Airports) ने दिल्ली एयरपोर्ट में बढ़ाई हिस्सेदारी, शेयर में रिकवरी की उम्मीद

- टाटा स्टील (Tata Steel), जिंदल स्टेनलेस, SAIL शेयरों में उछाल; चीन की उत्पादन कटौती से बढ़ी उम्मीद

Jeera ended higher on Saturday on buying interest at low-levels, but rising arrivals in the physical market and higher output estimates limited the upside. Arrivals are expected to pick up in the next few days and would be peaking in March-April. Spot jeera jumped 30 rupees to 11,802.15 rupees per 100 kg in Unjha.

Jeera ended higher on Saturday on buying interest at low-levels, but rising arrivals in the physical market and higher output estimates limited the upside. Arrivals are expected to pick up in the next few days and would be peaking in March-April. Spot jeera jumped 30 rupees to 11,802.15 rupees per 100 kg in Unjha.  Chana settled down with marginal change Saturday on selling at higher level continued to weigh on prices amid bearish fundamentals. March chana has fallen more than 25 percent as on Friday close from a Nov. 26 high on hopes of higher output due to expanded acreage, fears of government intervention to curb food inflation and ample carry-forward stocks.

Chana settled down with marginal change Saturday on selling at higher level continued to weigh on prices amid bearish fundamentals. March chana has fallen more than 25 percent as on Friday close from a Nov. 26 high on hopes of higher output due to expanded acreage, fears of government intervention to curb food inflation and ample carry-forward stocks.  Soybean on Saturday settled steady due to weak global cues. The downward revision in production estimate is supporting oilseed complex. In short-term, it will keep prices on higher side despite weak meal exports. Soyabean yesterday we have seen that market has moved 0.07%. Market has opened at 2084.5 & made a low of 2074.5 versus the day high of 2094.

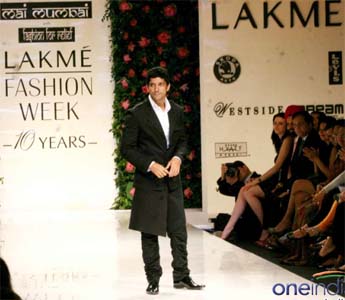

Soybean on Saturday settled steady due to weak global cues. The downward revision in production estimate is supporting oilseed complex. In short-term, it will keep prices on higher side despite weak meal exports. Soyabean yesterday we have seen that market has moved 0.07%. Market has opened at 2084.5 & made a low of 2074.5 versus the day high of 2094.  Mumbai, Feb 22 - Any fashion week is a trade event and the Lakme Fashion Week (LFW) here next month won't be an exception. Here too buyers will probably not be in a hurry to grab exclusive designs, but instead hunt for creative minds.

Mumbai, Feb 22 - Any fashion week is a trade event and the Lakme Fashion Week (LFW) here next month won't be an exception. Here too buyers will probably not be in a hurry to grab exclusive designs, but instead hunt for creative minds.