Survey: Indian Cell Phones Garner Sizeable Market Share In FY10

A latest survey said that fighting against the international names and grey market, the brands of Indian mobile cell phones have fortified their presence in India with a 14% market share by revenue.

A latest survey said that fighting against the international names and grey market, the brands of Indian mobile cell phones have fortified their presence in India with a 14% market share by revenue.

The survey, V and D100 Indian Telecom survey, conducted by telecom journal Voice and Data stated that the figure was up from 3-4% recorded during the last year.

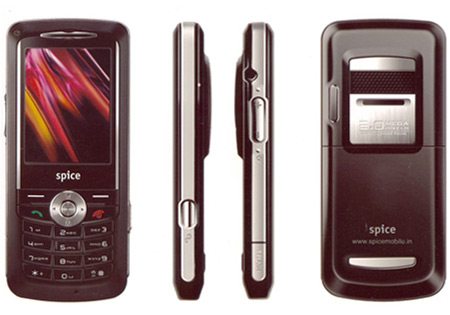

The Indian brands comprised Micromax, which possessed a 4.1% market share by revenue, Spice (3.9%), Karbonn (3%) and Lava (1.1%).

Compared with 2009, these Indian handset brands garnered a cumulative 10 percentage points of market share in the cutthroat Indian market, and Samsung hold 7 points, as Nokia shed 12 percentage points share.

The cellular phones in question are locally branded models sourced from makers in China or Taiwan.

Low prices for perceived high-end features, appeared to be the main reason for this hike,

According to Voice and Data chief editor Prasanto K Roy, "'You get all-QWERTY Blackberry look alikes complete with trackball, and even dual-SIM phones, for Rs 5,000. We saw demand rising for dual-SIM phones last year, but the market leaders had few offerings there. And while Nokia has many low-cost models, they are relatively sparse on features.'' Yet the low-cost local brands don't beat the market-leaders in all areas."

The mobile phone market climbed 4.2% by revenue during the last financial year. The low revenue growth hides the large numbers sold, but reflected the fact that most sales are of low-priced handsets, and that the average sale price (ASP) has been dropping each year.

Approximately 108 million handsets were sold in India during the last fiscal, adding up to Rs 27,000 crore in sales, up from Rs 25,910 crore the previous year.

The Voice and Data100 annual survey on cell phone is based on the revenue of telecom equipment suppliers, including GSM and CDMA handset vendors.

Cell phone major Nokia stayed on top with 52% share, in spite of a 15% revenue fall to Rs 14,100 crore.

Samsung stayed on the second largest handset vendor, with 17.4% market share, accompanied by LG at 5.9%. Sony Ericsson slipped badly in 2009, with very few options in the low- and mid-range handset segments.