Not long ago, accessing digital services meant sitting down at a computer, opening a browser, and navigating through multiple pages. Today, that routine feels outdated.

News in Focus

IDBI Capital has reiterated its HOLD rating on Tata Steel following a better-than-expected Q3FY26 performance, anchored by robust volume growth in India even as realizations softened.

ICICI Securities has reiterated a BUY call on Uno Minda following a robust Q3FY26 performance that underscored the company’s ability to outpace industry growth amid structural tailwinds.

Mazagon Dock Shipbuilders continues to demonstrate resilient execution across its naval programs, even as its order book gradually normalizes after several years of elevated backlog.

Hero MotoCorp’s Q3FY26 performance reinforces the durability of its core business at a time when the company is simultaneously investing heavily in electric mobility and global scale-up.

Jubilant Pharmova’s December quarter results reinforce a steady growth narrative even as near-term margin pressures temper earnings momentum.

Main Regional Stories

While the broader cryptocurrency market endured one of its steepest contractions in years, Tether’s USDT quietly delivered a striking counter-narrative.

Kyle Samani, chairman of Nasdaq-listed Forward Industries and a prominent Solana-aligned executive, has publicly condemned Hyperliquid, describing the platform as a symbol of “everything wrong with crypto.” His criticism targets both Hyperliquid’s

Bitcoin, Ethereum, Solana and other currencies witnessed support from lower levels and were trading firm during the weekend. BTC briefly went below $60K mark and has taken support from those levels.

Prabhudas Lilladher has reiterated a BUY recommendation on Pidilite Industries, underscoring sustained volume-led growth, resilient margins, and a steady medium-term earnings outlook despite rich valuations.

Authorities have said that emergency workers on Sunday were trying to rescue more than 300 people trapped by floodwaters that inundated southwest China.

Authorities have said that emergency workers on Sunday were trying to rescue more than 300 people trapped by floodwaters that inundated southwest China. After a weekend vacation in Maine that included hiking, bicycling and a tour of a historic light house, the U. S. first family was back in Washington.

After a weekend vacation in Maine that included hiking, bicycling and a tour of a historic light house, the U. S. first family was back in Washington. According to the reports, one passenger train smashed into the rear of another in India early Monday, and one official said the death toll could surpass 50.

According to the reports, one passenger train smashed into the rear of another in India early Monday, and one official said the death toll could surpass 50. Following the likes of Nokia and Apple, etc. now even the multi IT giant Dell has planned to join the fast growing mobile handset market in the world, by launching its own range of smart phones in India.

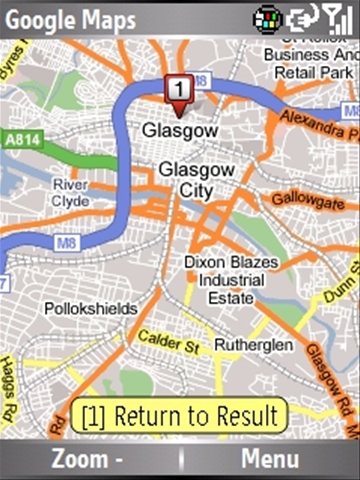

Following the likes of Nokia and Apple, etc. now even the multi IT giant Dell has planned to join the fast growing mobile handset market in the world, by launching its own range of smart phones in India. Nokia smartphone owners now have a reason to rejoice as Opera recently released the first ever beta of Opera Mobile 10.1 for the Symbian Series 60 models. The beta features of this new software are a faster speed and geolocation capabilities. The beta can be downloaded directly to a mobile handset from http://m. opera. com/ next/.

Nokia smartphone owners now have a reason to rejoice as Opera recently released the first ever beta of Opera Mobile 10.1 for the Symbian Series 60 models. The beta features of this new software are a faster speed and geolocation capabilities. The beta can be downloaded directly to a mobile handset from http://m. opera. com/ next/.