Icahn urges shareholders to appeal for share appraisal

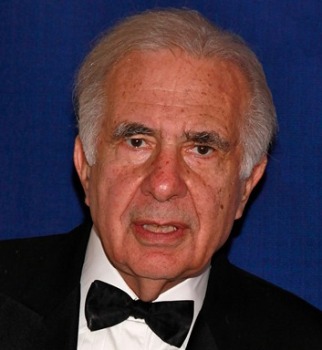

Carl Icahn, an activist investor associated with computing giant Dell, has asked the shareholders to demand a share appraisal from the company management in an effort to defeat a bid from company founder.

Carl Icahn, an activist investor associated with computing giant Dell, has asked the shareholders to demand a share appraisal from the company management in an effort to defeat a bid from company founder.

Dell's second-largest shareholder wrote an open letter to the shareholders aiming to convince them that the takeover offer form Michael Dell is not as generous or the smartest move strategically for the company. Icahn, who owns

8.7 per cent of the company, has also indicated that he will ask a court in Delaware to access if the $13.65 a share price offered by Mr. Dell is a fair value for the company's shares.

"What is most important about seeking appraisal is that you can change your mind about appraisal up to 60 days after the merger," Icahn wrote in his open letter.

It is believed that Michael Dell and Silver Lake Management are not likely to increase their bid valued at $24.4 billion for acquiring Dell Inc, according to people closer to the matter. Dell and Silver Lake have said that they will not increase the bid from $13.65-a-share offer, which was made in February saying that it is a fair and significant premium to the share value.

A special committee entrusted with the task of evaluation investment proposals in computing giant, Dell has said that it is backing a buyout proposal by Silver Lake Partners and founder Michael Dell that offers $13.65 a share to the shareholders. The backing of the proposal is a major setback for activist investor Carl Icahn. The special committee has written to the shareholders of Dell recommending them to vote in favour of Silver Lake and Michael Dell's takeover during the company's shareholder meeting on July 18, 2013.