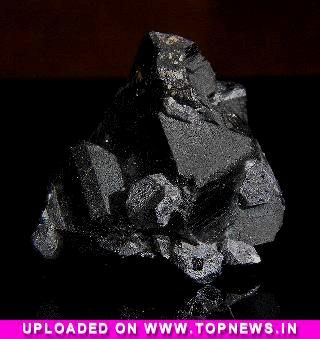

Commodity Trading Tips for Zinc by KediaCommodity

Zinc settled down -0.86% at 127.5 as pressure seen as slower Chinese growth indicated by recent economic signposts continued to weigh. Euro zone and US December inflation data were mild. Markets were little affected by Ben Bernanke’s last planned public remarks as head of the US Federal Reserve. The US initial jobless claims for last week were reported at 326,000, better than expectation and reflecting sustained recovery in labor market. December CPI growth advanced to 1.5% from 1.2%, matching estimates, but was still below the Fed’s 2.0% target. The Philly Fed manufacturing index for January was revised upward to 9.4. That, combined with the bright Empire State manufacturing index, allowed investors to be more optimistic on the ISM manufacturing index. However, financial statements released by several large US companies turned out disappointing, pressuring the US stock prices and weighing on base metals. Investors awaiting data from China due for release next week, including GDP growth, industrial value-added, and manufacturing index. LME zinc prices rose initially before falling, rising to USD 2,097/mt at one point, and meeting resistance at USD 2,100/mt, then dropping to USD 2,065/mt, finally closing at USD 2,071.8/mt, down USD 10.5/mt or 0.5%. Technically market is under long liquidation as market has witnessed drop in open interest by -11.31% to settled at 2618 while prices down -1.1 rupee, now Zinc is getting support at 126.7 and below same could see a test of 125.8 level, And resistance is now likely to be seen at 128.9, a move above could see prices testing 130.2.

Zinc settled down -0.86% at 127.5 as pressure seen as slower Chinese growth indicated by recent economic signposts continued to weigh. Euro zone and US December inflation data were mild. Markets were little affected by Ben Bernanke’s last planned public remarks as head of the US Federal Reserve. The US initial jobless claims for last week were reported at 326,000, better than expectation and reflecting sustained recovery in labor market. December CPI growth advanced to 1.5% from 1.2%, matching estimates, but was still below the Fed’s 2.0% target. The Philly Fed manufacturing index for January was revised upward to 9.4. That, combined with the bright Empire State manufacturing index, allowed investors to be more optimistic on the ISM manufacturing index. However, financial statements released by several large US companies turned out disappointing, pressuring the US stock prices and weighing on base metals. Investors awaiting data from China due for release next week, including GDP growth, industrial value-added, and manufacturing index. LME zinc prices rose initially before falling, rising to USD 2,097/mt at one point, and meeting resistance at USD 2,100/mt, then dropping to USD 2,065/mt, finally closing at USD 2,071.8/mt, down USD 10.5/mt or 0.5%. Technically market is under long liquidation as market has witnessed drop in open interest by -11.31% to settled at 2618 while prices down -1.1 rupee, now Zinc is getting support at 126.7 and below same could see a test of 125.8 level, And resistance is now likely to be seen at 128.9, a move above could see prices testing 130.2.

Trading Ideas:

Zinc trading range for the day is 125.8-130.2.

Zinc dropped as pressure seen as slower Chinese growth indicated by recent economic signposts continued to weigh.

Ben Bernanke said QE taper and “forward guidance” on how long the Fed will keep interest rates low were helpful.

Zinc daily stocks at Shanghai exchange came up by 977 tonnes