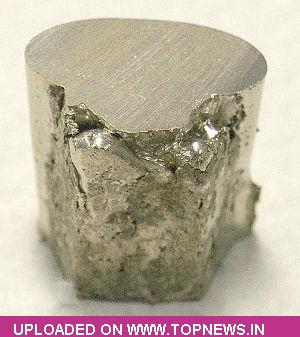

Commodity Trading Tips for Nickel by KediaCommodity

Nickel settled up 1.05% at 875.2 after data showed HSBC's December PMI for China was finally 50.5, expanding for the fifth straight month. The number of US initial jobless claims last week decreased for the second consecutive week, when combined with QE3 wind-down, the US dollar index rebounded to 80 due to strong risk aversion sentiment.

Nickel settled up 1.05% at 875.2 after data showed HSBC's December PMI for China was finally 50.5, expanding for the fifth straight month. The number of US initial jobless claims last week decreased for the second consecutive week, when combined with QE3 wind-down, the US dollar index rebounded to 80 due to strong risk aversion sentiment.

The HSBC China manufacturing PMI for December was finalized at 50.5, on par with the preliminary reading and touching a three-month low. However, the index has remained above 50 for a fifth month straight, a sign of continued expansion of Chinese manufacturing. New export orders sub-index fell below 50 for the first time in four months to 49.1, due to waning demand overseas during the Christmas and New Year period.

As the lower index was primarily attributable to seasonal factor, metals markets were little affected and staged continuous rises during Asian trading hours, an indication that investors were still optimistic on Chinese manufacturing. The December ISM manufacturing index was 57.0, exceeding expectations but still trailing November's figure. Markit manufacturing PMI for the US nudged up from 54.4 to 55.0 in December. The US stocks and base metals kept falling in the wake of these releases.

LME nickel prices opened at USD 13,980/mt on Thursday, with the high end of the price range USD 14,099/mt, and finding support at USD 13,792/mt. Finally, LME nickel prices closed at USD 13,995/mt, down USD 93/mt from the previous trading day. Technically market is under short covering as market has witnessed drop in open interest by -12.6% to settled at 5734 while prices up 9.1 rupee, now Nickel is getting support at 865.1 and below same could see a test of 854.9 level, And resistance is now likely to be seen at 883, a move above could see prices testing 890.7.

Trading Ideas:

Nickel trading range for the day is 854.9-890.7.

Nickel gained after data showed HSBC's December PMI for China was finally 50.5, expanding for the fifth straight month

The number of US initial jobless claims last week decreased for the second consecutive week, when combined with QE3 wind-down

n the euro zone, final reading of manufacturing PMI for December matched forecast, but the gap between France and Germany continued to widen.