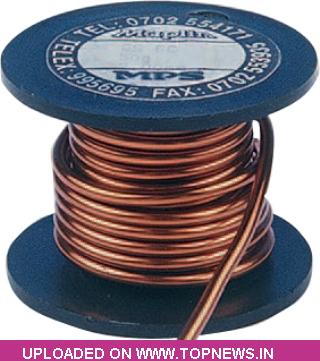

Commodity Trading Tips for Copper by KediaCommodity

Copper settled flat at 428.95 after US existing home sales for June were reported above forecast, while core CPI for the same month was lower than expected. Risk appetite grew after several US companies reported satisfactory performance for the latest quarter. US core CPI climbed only 0.1% in June, shy of the estimated 0.2% increase. These encouraging economic reports gave a boost to market sentiment, with the Standard & Poor’s 500 index setting new highs. The global world refined copper market showed a 183,000 tonne deficit in April, compared with an 84,000 tonne deficit in March, the International Copper Study Group said. The People’s Bank of China (PBOC) reported that China’s forex receipts at financial institutions dwindled RMB 88.3 billion to RMB 29.45 trillion in June, down for the first time after rising in 10 straight months. The fall in forex receipts suggests that China’s injection of liquidity looks set to change. Market sentiment should remain bullish on Wednesday since HSBC’s China manufacturing PMI is expected to come in positive on Thursday. The minute of Bank of England's policy meeting will be the focus of markets today. Market talk points to the Fed ending its bond-buying program around October and then raising interest rates some time in 2015, though the length of time that will pass between those two policy moves remains up in the air. Technically market is under fresh buying as market has witnessed gain in open interest by 4.74% to settled at 9859 while prices up 0.4 rupee, now Copper is getting support at 427.2 and below same could see a test of 425.3 level, And resistance is now likely to be seen at 431.8, a move above could see prices testing 434.5.

Copper settled flat at 428.95 after US existing home sales for June were reported above forecast, while core CPI for the same month was lower than expected. Risk appetite grew after several US companies reported satisfactory performance for the latest quarter. US core CPI climbed only 0.1% in June, shy of the estimated 0.2% increase. These encouraging economic reports gave a boost to market sentiment, with the Standard & Poor’s 500 index setting new highs. The global world refined copper market showed a 183,000 tonne deficit in April, compared with an 84,000 tonne deficit in March, the International Copper Study Group said. The People’s Bank of China (PBOC) reported that China’s forex receipts at financial institutions dwindled RMB 88.3 billion to RMB 29.45 trillion in June, down for the first time after rising in 10 straight months. The fall in forex receipts suggests that China’s injection of liquidity looks set to change. Market sentiment should remain bullish on Wednesday since HSBC’s China manufacturing PMI is expected to come in positive on Thursday. The minute of Bank of England's policy meeting will be the focus of markets today. Market talk points to the Fed ending its bond-buying program around October and then raising interest rates some time in 2015, though the length of time that will pass between those two policy moves remains up in the air. Technically market is under fresh buying as market has witnessed gain in open interest by 4.74% to settled at 9859 while prices up 0.4 rupee, now Copper is getting support at 427.2 and below same could see a test of 425.3 level, And resistance is now likely to be seen at 431.8, a move above could see prices testing 434.5.

Trading Ideas:

Copper trading range for the day is 425.3-434.5.

Copper settled flat after US existing home sales for June were reported above forecast

The global world refined copper market showed a 183,000 tonne deficit in April, compared with an 84,000 tonne deficit in March - ICSG

Supply growth is seen putting downward pressure on copper prices this year, but the falls are expected to be cushioned by steady demand.