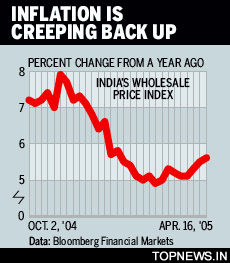

Inflation dips marginally

The wholesale price index (WPI) based inflation rate continued to decline in the second consecutive week and now stands at 8.90 per cent. The inflation was 8.98 per cent a week ago. Declining trend brings a respite for the central government, which is facing flak for rising prices.

The wholesale price index (WPI) based inflation rate continued to decline in the second consecutive week and now stands at 8.90 per cent. The inflation was 8.98 per cent a week ago. Declining trend brings a respite for the central government, which is facing flak for rising prices.

It has also paved a way for Reserve Bank to further revise key interest rate to improve liquidity condition in the financial system. Economists believe that it can further slide even below the expectations of the Reserve Bank in the coming days.

The Union Government is likely to cut prices of petroleum products and LPG after more fall in prices of crude oil in international market at present. The decision may be taken near the time of general elections. The recent drop in valuation of Indian currency against US Dollar has kept the cost of Crude higher for India.

The recent drop in inflation rate is mainly due to decline in prices of crude oil in international market which are varying in between $50-$60 and lower demand. However, prices of primary articles went up by 65 basis points to 11.66 per cent in the week up to November 8 this year. Manufactured product category reported significant decline in the reporting week. The stock market has not shown any positive trend despite significant fall in politically sensitive inflation rate.