Lead Market Update by Kedia Commodity

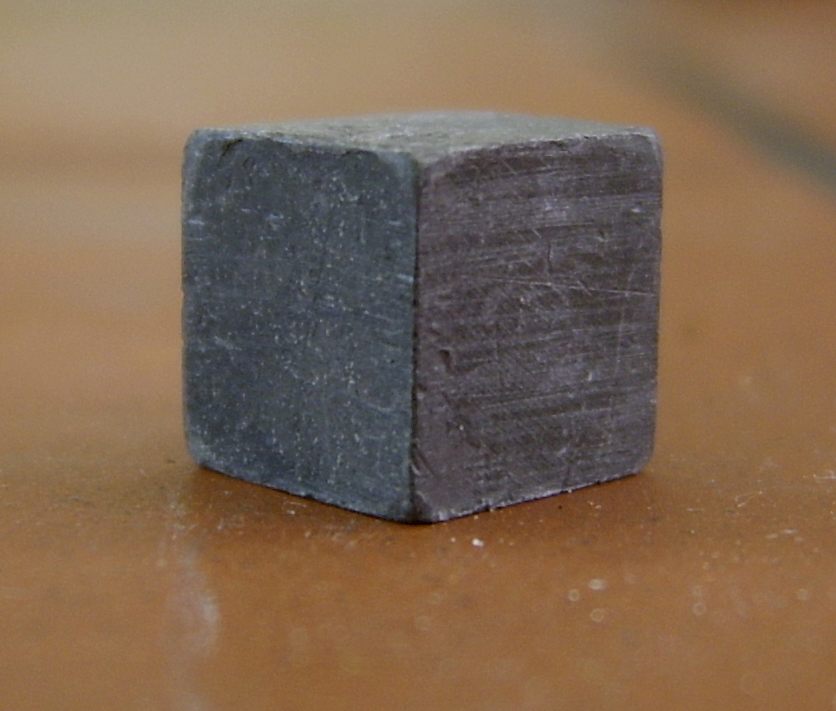

Lead trading with the negative node -0.49% down at 123 in today's trading session lead has touched the low of 121.75 after opening at 123.15, and made a high of 123.50. Lead prices after dropping from 120 to nearly 108.75 in first week of March 2011, it has shown stunning recovery and bounce back due to huge demand of battery after earthquake and Tsunami hit Japan. And Lead is emerging as the base metal likely to see the fastest demand-side boost from the crisis in Japan. But considering the monetary policies in Japan and weak home sales in US can push the prices to downside. On China monetary front, China has raised its reserve ration requirement again, by 50 basis points effective from March 25th 2011.

Lead trading with the negative node -0.49% down at 123 in today's trading session lead has touched the low of 121.75 after opening at 123.15, and made a high of 123.50. Lead prices after dropping from 120 to nearly 108.75 in first week of March 2011, it has shown stunning recovery and bounce back due to huge demand of battery after earthquake and Tsunami hit Japan. And Lead is emerging as the base metal likely to see the fastest demand-side boost from the crisis in Japan. But considering the monetary policies in Japan and weak home sales in US can push the prices to downside. On China monetary front, China has raised its reserve ration requirement again, by 50 basis points effective from March 25th 2011.

Battery Demand Scenario: According to GS Yuasa Corp., the world's third-biggest producer “Global demand for lead-acid batteries may rise 2.6 percent this year amid increased car sales in China, India and Southeast Asia”. According to China Association of Automobile Manufacturers forecast “China's vehicle sales will grow 10 percent to 15 percent this year after jumping 32 percent to 18.06 million vehicles in 2010”. According to Kyto Japan based Co “Demand in China will increase 9 percent to 49 million units in 2011 and then 54 million units in 2012, while consumption in India may climb to 14.5 million units in 2011 and then 16 million in 2012 from 13 million last year "

The Japan Earthquake and Tsunami impact: The Lead market has been working through the demand implications of the unfolding multiple crisis in Japan and has alighted on lead as the metal most likely to be the main short-term beneficiary. Even before the reconstruction effort gets under way, a process that will have implications for metals such as steel, copper and aluminum, what Japan will need most is power. Infrastructure damage, as well as the obvious impact on generation of the stricken Fukushima Daiichi nuclear plant, has left 850,000 households in the north of the country without electricity. The scale of the power problem was underlined last week with a warning from trade minister Banri Kaieda that Tokyo could experience large scale outages. Backup generators for infrastructure, utilities and businesses will be working over time, accelerating replacement times and boosting demand for the lead that makes the batteries work.