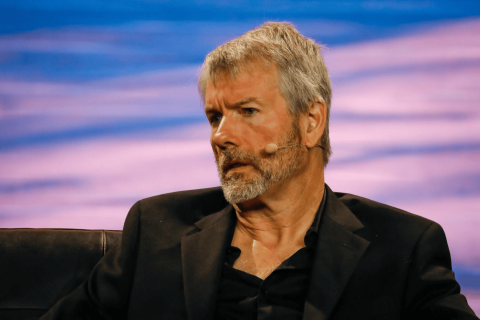

Michael Saylor Clarifies that Strategy is Still Bullish on Bitcoin; Wallet Shuffles Routine Process

Michael Saylor, the outspoken leader of Strategy, swiftly moved to dispel market fears after on-chain data showing $5.7 billion worth of Bitcoin transfers ignited rumors of a selloff. The speculation sent Strategy’s stock (MSTR) tumbling and triggered wild swings in betting markets. However, the company clarified that the transactions were routine custody management, not a liquidation. Analysts later confirmed these wallet movements reflected standard housekeeping rather than market exits. Despite a temporary dip in confidence, Saylor reaffirmed Strategy’s unwavering commitment to accumulating Bitcoin, maintaining its position as the largest corporate holder of the digital asset.

Market Panic Erupts Over Strategy’s $5.7 Billion Bitcoin Transfer

Rumors of a Bitcoin selloff by Strategy, formerly MicroStrategy, briefly sent tremors through the crypto market this week after blockchain data revealed vast transfers of the company’s holdings. The figures pointed to $5.7 billion in Bitcoin being moved between wallets linked to the firm — a revelation that quickly set X (formerly Twitter) and Telegram channels alight.

Posts from widely followed accounts, including Walter Bloomberg, suggested the company’s Bitcoin reserves had fallen from 484,000 BTC to 437,000 BTC, citing tracking data from Arkham Intelligence. That triggered an immediate reaction among traders, with Strategy’s shares (MSTR) plunging below $200, before stabilizing just above that level during Nasdaq’s opening bell.

Meanwhile, the rumor mill found fuel in speculative markets. On decentralized predictions platform Polymarket, the odds of Strategy selling any Bitcoin before 2026 spiked dramatically — climbing from 3% to 45% in just hours. For traders, the evidence of large outbound transfers combined with the sudden pricing dynamics looked like a potential strategic pivot by Saylor, who had long characterized Bitcoin as “digital gold.”

Arkham Intelligence Clarifies: Routine Custody, Not a Selloff

The panic began to subside once Arkham Intelligence issued a public clarification, explaining that the wallet movements did not represent sales. Instead, the firm described the activity as a standard custodian reshuffle — common practice for institutions managing large-scale digital assets.

In other words, this was a routine operational event. Custody transitions of this size can happen when an organization updates security infrastructure, rotates vault providers, or reorganizes internal wallet architecture. Blockchain observers corroborated this interpretation, noting that none of the transferred Bitcoin had been sent to exchanges, which would be a telltale sign of preparation for liquidation.

That statement steadied nerves and began reversing the narrative that Strategy had quietly dumped its signature asset.

Saylor’s Swift Rebuttal: “We Are Buying Bitcoin”

Michael Saylor’s intervention came swiftly and decisively. Appearing on CNBC’s morning segment, the Strategy chairman dismissed the reports as “completely untrue,” declaring, “We are buying Bitcoin. We’ll report our next buys on Monday morning.”

The comment underscored Saylor’s enduring conviction in Bitcoin as a core treasury reserve. His message on X reinforced it further: “There is no truth to this rumor.” The post also hinted that the firm’s wallet activity could actually signal continued accumulation of assets rather than divestment.

Within hours, the market began to recover. Betting odds on Polymarket collapsed back to 4%, reflecting renewed confidence that Strategy had not — and would not — sell. MSTR shares rebounded above $200, closing the day modestly higher as panic gave way to perspective.

Saylor’s comments marked not only a rebuttal to the rumors but a reaffirmation of the company’s broader “Bitcoin-as-corporate-reserve” thesis — a vision that has defined Strategy’s identity since its 2020 pivot toward digital assets.

Strategy’s Bitcoin Empire Remains Intact

Strategy stands today as the largest corporate holder of Bitcoin globally, with a reported 641,692 BTC valued at roughly $62 billion. The company’s crypto treasury dwarfs every other corporate balance sheet exposure in the space, solidifying its role as an institutional leader in the digital-asset ecosystem.

Yet despite the magnitude of its holdings, Strategy’s equity performance has not mirrored Bitcoin’s stability. Year-to-date, MSTR shares have fallen 29%, reflecting volatility in market sentiment and ongoing concerns about leverage exposure. By contrast, Bitcoin itself has been relatively flat, hovering near $97,000 after descending from an earlier high of $126,000.

These figures illustrate a widening gap between Strategy’s operational narrative and investor expectations. While the company’s balance sheet remains heavily weighted toward Bitcoin, shareholders have repeatedly voiced calls for greater transparency. This includes requests for proof of reserves or published wallet addresses, neither of which Saylor has agreed to — citing security concerns as the overriding factor.