Stock Mkts May See Correction In Near Term: Angel Broking

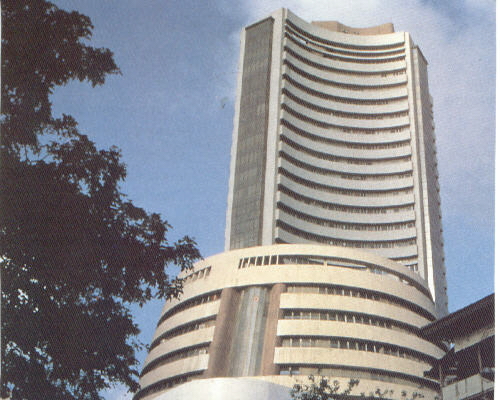

Indian stock markets ended the choppy day on a positive note on Friday, taking support from optimistic global indications.

Indian stock markets ended the choppy day on a positive note on Friday, taking support from optimistic global indications.

Consumer durables, PSU, banking and IT stocks were the major supporters of the market, whereas profit booking was seen accross FMCG, realty and oil & gas stocks.

BSE Midcap index lost 0.13%, while BSE Smallcap index was down by 0.38%.

The index for industrial production (IIP) for the month of July 2009 declined 6.8% as against 7.8% during June 2009. The administration has modified the June IIP figure to 8.2% from 7.8%.

The Sensex, which opened the day after making a gain of 37.71 points, ended the day at 16, 264.30, up 47.44 points. It hit an intra-day high of 16,337.98 and an intra-day low of 16,130.32.

On the other hand, the broad-based Nifty closed at 4,829.55, up 10.15 points after touching an intra-day high of 4,856.15 and an intra-day low of 4,791.55.

The top gainers' during the day comprises ICICI Bank, Hindalco Industries, Infosys Technologies, Bharti Airtel, Tata Steel and Wipro.

On the other hand, the stocks, which dragged down included DLF, JP Associates, Hero Honda Motors, HUL, Maruti Suzuki India, and Grasim Ind.

While commenting on the stock market viewpoint for Monday, Vaishnavi Jagtap, technical analyst, Angel Broking stated that the stock markets are precautious at upper levels and the preceding move, which commenced from Sensex/Nifty at 15,357 to 16,435 / 4,577 to 4,889 levels may see correction.

"On the downside, if indices trades below 16,130 / 4,791 levels then it may test 16,023 - 15,896 / 4,770 - 4,734 levels. Whereas on the upside, 16,340 - 16,435 / 4,860 - 4,890 levels may act as resistance for the day," Vaishnavi added.

She also said that short term investors are suggested to follow stock specific strategies going ahead.