Commodity Trading Tips for Nickel by KediaCommodity

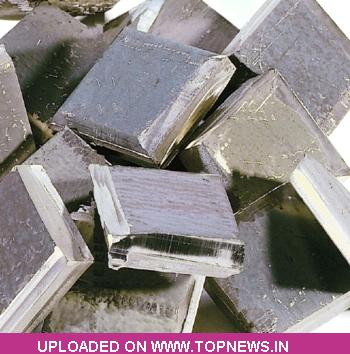

Nickel yesterday settled up 0.11% at 816.30 recovered from the earlier day's fall tracking LME nickel prices which closed at USD 13,843/mt, down USD 314/mt. Base metals prices dropped across the board last Friday due to concerns over China's economy and since investment banks lowered their expectations of US economic growth, and since Morgan Stanley exited spot trading market. LME nickel prices fell back below USD 14,000/mt, its largest decline of 2.22% in two weeks, and finally closing at USD 13,843/mt. In Shanghai, Jinchuan nickel prices were around USD 99,600/mt, and Russian nickel prices were around RMB 98,400/mt. Downstream buyers lacked interest to purchase, with transactions mainly made among traders. Also base metals prices were affected by concerns over China's demand. The list of outdated capacity elimination in 19 industries was released, and the market was concerned slower Chinese economic growth and sliding manufacturing will reduce demand for base metals. Besides, investment banks are selling spot base metals, and JP Morgan announced last Friday it would seek for strategic substitute for spot commodity business, including selling and quitting spot commodity business, or implement strategic cooperation with those business, which pushed down base metals prices. Technically market is under fresh buying as market has witnessed gain in open interest by 0.13% to settled at 12145 while prices up 0.9 rupee, now Nickel is getting support at 815.2 and below same could see a test of 814.1 level, And resistance is now likely to be seen at 817.5, a move above could see prices testing 818.7.

Nickel yesterday settled up 0.11% at 816.30 recovered from the earlier day's fall tracking LME nickel prices which closed at USD 13,843/mt, down USD 314/mt. Base metals prices dropped across the board last Friday due to concerns over China's economy and since investment banks lowered their expectations of US economic growth, and since Morgan Stanley exited spot trading market. LME nickel prices fell back below USD 14,000/mt, its largest decline of 2.22% in two weeks, and finally closing at USD 13,843/mt. In Shanghai, Jinchuan nickel prices were around USD 99,600/mt, and Russian nickel prices were around RMB 98,400/mt. Downstream buyers lacked interest to purchase, with transactions mainly made among traders. Also base metals prices were affected by concerns over China's demand. The list of outdated capacity elimination in 19 industries was released, and the market was concerned slower Chinese economic growth and sliding manufacturing will reduce demand for base metals. Besides, investment banks are selling spot base metals, and JP Morgan announced last Friday it would seek for strategic substitute for spot commodity business, including selling and quitting spot commodity business, or implement strategic cooperation with those business, which pushed down base metals prices. Technically market is under fresh buying as market has witnessed gain in open interest by 0.13% to settled at 12145 while prices up 0.9 rupee, now Nickel is getting support at 815.2 and below same could see a test of 814.1 level, And resistance is now likely to be seen at 817.5, a move above could see prices testing 818.7.

Trading Ideas:

Nickel trading range for the day is 814.1-818.7.

Nickel settled firm despite market was concerned slower Chinese economic growth and sliding manufacturing will reduce demand for metals

University of Michigan's July CCI was 85.1, a record high since March 2007, but this did not boost the US dollar index

University of Michigan consumer confidence index was 85.1, above the 84.0 expected and hitting the highest level since March 2007.