Crude Daily Commentary for 4.1.09

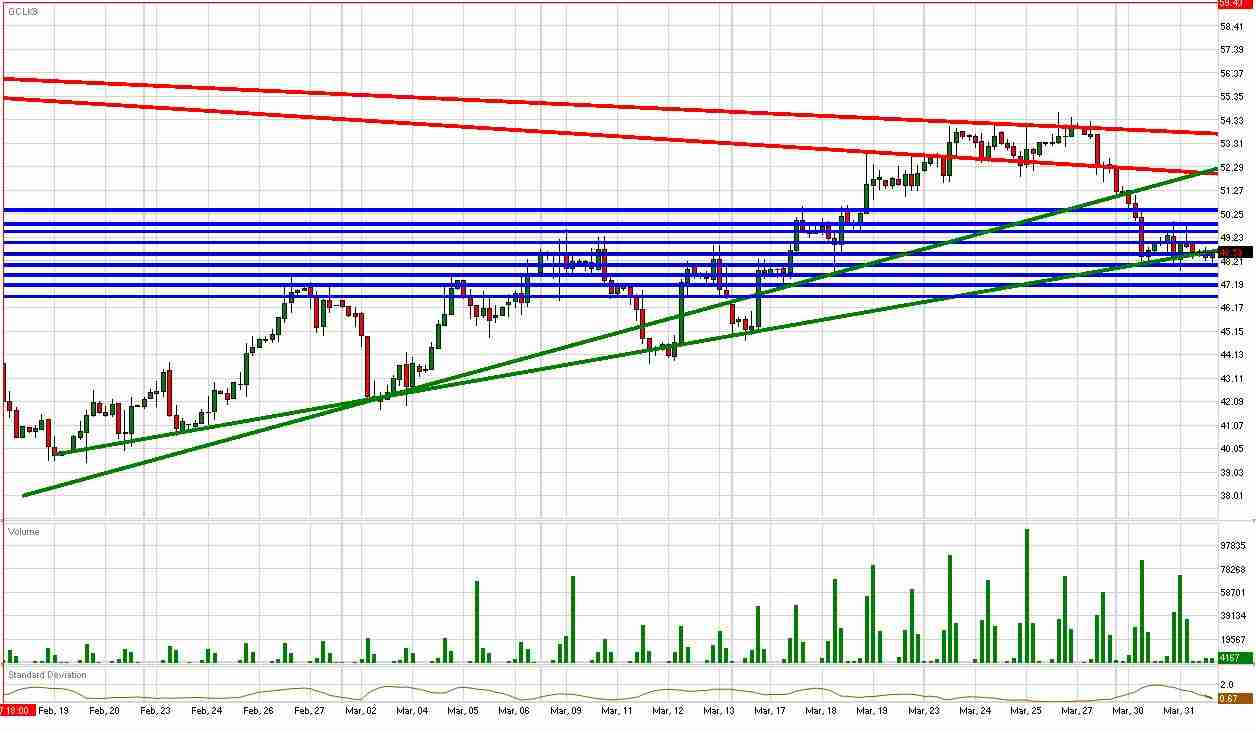

Crude futures are sitting right on our 1st tier uptrend line as investors await key economic data from the U.S. including the weekly Crude Oil Inventory number. Inventories have risen beyond analyst expectations for the last four weeks. Crude futures are already under pressure from what appears to be pending bankruptcies from both GM and Chrysler.

Considering the impact the failure of two of America’s major car manufacturers are having on the outlook for future consumption, higher than expected inventories could send crude futures spiraling lower. Crude futures are already trading below the psychological $50/bbl. If our 1st tier uptrend line can’t hold, we could see the futures drop suddenly towards the $45.50/bbl-$46/bbl area.

On the other hand, if crude futures can fight back above the 1st tier uptrend line, they still have to face the highly-psychological $50/bbl. Therefore, the momentum is to the downside for crude. Fundamentally, we find resistances of $49.01/bbl, $49.49/bbl, $49.81/bbl, and $50.41/bbl. To the downside, we see supports of $48.51/bbl, $48.03/bbl, $47.61/bbl, $47.18/bbl, and $46.67/bbl. Crude futures are presently trading at $48.55/bbl.

Copyright 2009 FastBrokers, Latest Forex News and Analysis for Forex, Bullion and Commodity Traders.