Trade Setup for 25 June; NSE Nifty Targets 25500 Levels as Middle East Tension Eases

The market experienced a highly speculative movement today, following the Middle East crisis, as it nearly reached a new six-month high around the 25,300 level. However, after a few developments that were previously considered positive did not materialize—such as the expected ceasefire between Iran and Israel—Nifty gave up the gains. It eventually closed near the 25,000 level, ending at approximately 25,044.

Earlier this morning, an announcement was made by U.S. President Donald Trump regarding the ceasefire between the two countries. This development, coming after 12 hours, created a very significant market movement, pushing it to a strong upside high.

Global Market Analysis

Iran-Israel Ceasefire Violation

Both countries were considered to have agreed to a ceasefire, as announced by U.S. President Donald Trump. However, after reaching the agreement, both Iran and Israel violated the ceasefire. The war, which has been ongoing for the past 12 days, is now approaching an end, but with considerable uncertainty.

During this period, several major developments occurred, including the direct involvement of the U.S., which carried out a significant attack on nuclear facilities.

According to international law, Iran claims that the U.S. has violated its sovereignty as a nation. At the same time, the U.S. stated that it is targeting Iran's nuclear program through a series of military actions. In response, there was an attack on a U.S. military base in Qatar, which led to a retaliatory strike by the U.S. These developments have escalated tensions between the two major Middle Eastern powers, Iran and Israel.

U.S. GDP Data to announced

This week, the U.S. is set to announce the GDP data for the current quarter. Analysts are closely watching this release, as it is expected to have a significant impact on the ongoing Fed policy. Interest rates remain high due to ongoing economic instability and the negative effects of tariffs, which have not been favourable for the economy.

The U.S. has witnessed mixed GDP data, showing both upside and downside trends. In the previous quarter, the economy recorded a contracted GDP growth of 0.2% in Q1 2025. Now, the upcoming Q2 data is expected to be a key indicator for the economy. It is anticipated to show a similar contraction of around 0.2%. This will be an important factor in determining whether the Fed continues to maintain high interest rates or not.

This also reflects on investors and company stakeholders, influencing their confidence and decisions regarding further capacity building and belief in the U.S. economy.

Domestic Market Analysis

IPO buzz is running

The Indian equity market is witnessing strong momentum, driven by several positive developments. Sentiment remains upbeat as India continues to take progressive steps, particularly in the IPO space. Currently, more than seven IPOs are active, receiving strong investor interest. This trend is a positive sign for the overall market. Companies like BSE and CDSL are expected to benefit significantly, as they generate substantial revenue from IPO activity. The rise in IPOs could contribute to increased earnings for such companies.

Some of the key upcoming IPOs that are gaining significant attention include HDB Financial Services and Tata Capital. In addition to these, NSDL is also preparing for its listing and is ready to enter the market. These companies are among the few that are drawing strong interest as they plan to list on the Indian equity market.

Crude Oil Prices Down; Ceasefire impact

Brent crude is experiencing highly volatile movements due to the ongoing Middle East crisis, as a significant portion of the world’s crude supply comes from that region. Additionally, the Strait of Hormuz—an important route near Asia’s oil supply—is also in focus. After initially rising due to geopolitical tensions, crude prices dropped again following the ceasefire announcement. As a result, Brent crude has fallen below the $70 mark.

Countries like India and China, which are net importers of crude oil, are heavily impacted by such price movements. If crude oil prices stay above $80 for a long time, their import bills are likely to rise significantly. This is a crucial factor, as it was previously believed that India could be a net loser due to higher crude prices. However, the recent drop in prices could be seen as a positive sign for oil-importing countries like India.

FII-DII Data Analysis

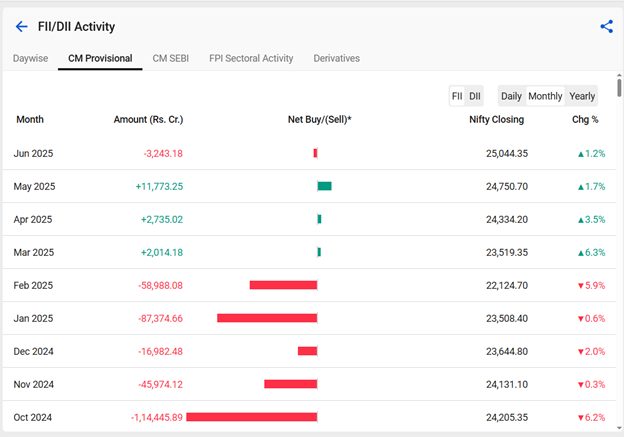

Foreign Institutional Investors (FIIs) are taking a cautious approach amid the ongoing volatility in the Nifty 50. In today’s trading session, FIIs sold nearly ₹5,266 crore worth of equities in the Indian market. This selling pressure comes in the backdrop of the ongoing Middle East crisis, which remains a key concern for global and domestic investors alike.

At the same time, Domestic Institutional Investors (DIIs) supported the market by buying equities worth nearly ₹5,209 crore today, along with over ₹5,000 crore in the previous session. This consistent buying is helping to provide support and sustain the positive momentum in the Nifty 50 despite the ongoing volatility.

Now, a key concern has emerged as FIIs have once again turned into net sellers, with net outflows reaching around ₹3,243 crore. This is significant because after a brief period of buying in Indian equities, they have resumed selling. This negative sentiment is also preventing the market from crossing and sustaining above the 25,200 level at closing.

Nifty 50 Technical Analysis

Following the ceasefire news in the morning, Nifty showed a strong upward movement, and it appeared that the index might close above the 25,000 level. However, it failed to do so due to the violation of the ceasefire later in the day, which led to market uncertainty and weakness.

On the technical front, the trendline on the daily timeframe is currently acting as a support near the 25,000 level. This is a crucial level—if Nifty closes below it, we may witness a breakdown from the sideways movement that has been forming.

At the same time, the market made a new intraday high today by crossing the 25,300 marks, which is also significant. If the market maintains this momentum and avoids closing below 25,000, we may soon see another attempt to reach new highs.

Conclusion

The key concern now is whether Nifty can sustain above the 25,000 level. If this level holds, we may see a sustainable upward movement, breaking out of the consolidation phase that has lasted for the past month. This would be a positive sign, especially if FIIs turn into net buyers again.

However, everything depends on two critical factors:

Whether the ceasefire in the Middle East holds.

How the market reacts to the upcoming end of the 90-day U.S. tariff period.

These events will play a major role in deciding the next direction for the market, especially for Nifty around the crucial 25,000 mark.