Trade setup for 22 May; NSE Nifty Support at 24,600, Israel on Iran nuclear site attack; FII & DII both Net Buyers

A volatile day for the Nifty has passed, with the index maintaining its position in the choppy zone, as we discussed in the previous blog—expecting Nifty to trade between 24,600 and 25,200 levels. The market showed strong movement today, making a high of nearly 250 points in the opening session. After that, it experienced a significant correction from the high, eventually closing with a gain of around 130 points.

Mid-session, when Nifty made the high, it turned flat and then quickly lost around 250 points over the next couple of five-minute candles. Following this, the index showed a recovery, forming a strong hammer pattern, and ended the day with a gain of approximately 130 points in Nifty 50.

Global Market Analysis

US and Israel on Attacking Iran’s Nuclear Sites

Reports have emerged suggesting that Israel is planning an attack on Iran’s nuclear sites. This development is a significant negative factor, particularly for the oil sector. For oil-importing countries like India, this could have serious economic implications due to potential spikes in crude oil prices.

Such reports about potential strikes on nuclear sites are not new. During the Trump administration, the US often made such intentions public to gain leverage in negotiations. This strategy aimed to create pressure and secure a stronger position when diplomatic talks resumed.

Following these developments, crude oil prices jumped nearly 1% from their low levels. This is a negative factor for countries like India, which maintains strong relations with both Iran and Israel.

Nvidia CEO on Curbing AI Chip

Recently, Nvidia's CEO stated that US chip companies could face significant losses due to the rising tariffs imposed on China. A substantial portion of chip sales comes from the Chinese market, and these new tariffs could severely impact revenue.

In the case of AI, China is witnessing rapid technological advancements and strong adoption. To support this growth, China needs access to advanced chips, and Nvidia, being a global leader, plays a crucial role. While it was expected that the rise of AI would boost chip demand and benefit US companies, the ongoing tariff war is now casting doubt on that optimism.

Huang also praised the Trump administration's approach to AI, highlighting its stance on easing price restrictions. He noted that the administration demonstrated that U.S. companies are not the sole providers of such technology, implying that strict regulations or restrictions could lead to significant losses for American firms. This, according to Wang, is why the former president took a more supportive stance.

Israel to Take Full Control of Gaza

A significant global reaction has followed Israel's announcement that it plans to take full control over the Gaza Strip after a prolonged conflict. Israel has declared its intention to bring the entire area under its authority.

Several Western countries, including the UK, France, and Canada, have criticized this decision. Meanwhile, the United States has not yet made an official comment. The move is particularly controversial given that Hamas still operates actively in the region.

Many Muslim-majority countries have strongly opposed Israel's decision, viewing it as a violation of international norms. However, it does not appear that Israel is considering stepping back from its stance.

Domestic Market Analysis

The market is currently experiencing choppy movements—at times appearing volatile, as seen in today's price action. It seems to be moving within a repeated range, showing a lack of clear direction. This is likely because the market has already priced in most of the previous positive news at key levels.

Now, attention turns to upcoming developments, particularly how tariffs-related announcements unfold and how global deals, especially involving the USA, progress. These factors will play a crucial role in shaping the market setup in the coming sessions.

Big Sectors Showing Sideways Movement

Major sectors that significantly contribute to the Nifty 50—such as Financial Services, IT, and Pharma—are not showing much movement lately. This is likely because much of the positive news has already been priced in earlier. These sectors are typically market leaders and play a key role in driving Nifty's direction.

On the other hand, the defense sector is showing notable strength, driven by India’s recent successes and future business expectations in the sector. However, since defense stocks have a relatively low weightage in the index, their impact on the overall Nifty movement has been limited despite their strong individual performance.

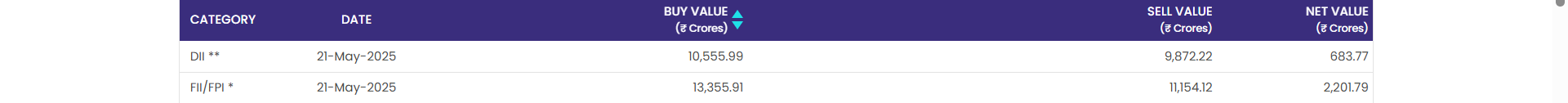

FII and DII Data Analysis

After nearly ₹10,000 crore worth of selling by FIIs that dragged the market lower, they have now turned net buyers again, purchasing approximately ₹2,200 crore in the Indian equity market today. Alongside them, DIIs also made a strong contribution by buying around ₹683 crore in the cash market.

With both FIIs and DIIs turning net buyers, it’s a very positive signal for the market. This has supported the Nifty 50 in gaining nearly 30 points over the last two trading sessions. Going forward, FII activity will be crucial in determining whether Nifty can continue its upward momentum and move toward its all-time high levels.

Nifty 50 Technical Outlook

The 25,200 level is acting as a strong resistance zone for Nifty 50. If FIIs do not contribute significantly through fresh buying, we may continue to see selling pressure around this level. The 25,000 level has also proven to be a resistance point recently, mainly due to the lack of fresh triggers and the fact that previous positive developments have already been priced in.

On the downside, intraday price action has shown strong support forming near the 24,600 level. Based on the overall technical setup, Nifty 50 is currently trading within a range, with immediate resistance at 25,000–25,200 and strong support around 24,600.

Conclusion

The market is expected to remain choppy in the near term. The primary reason is that most of the positive news has already been discounted. Based on technical analysis, Nifty 50 is likely to trade within a range of 24,600 to 25,200 in the coming sessions.

Any major global development—especially from the USA—could potentially impact the Indian market sentiment. In particular, the Nifty IT sector has significant room for upside and could become a key contributor to pushing the Nifty 50 higher if positive triggers emerge.