Trade Setup for 18 June; NSE Nifty Trades in 25,200–24,500 Zone as Fed Meeting Begins Today

The market is showing indecisive movement, influenced by global cues and upcoming events, as the Middle East crisis continues to escalate without a clear resolution due to the ongoing conflict between Israel and Iran. Additionally, the upcoming Fed meeting is also a crucial factor contributing to the mixed sentiment in the market. In the previous session, Nifty showed nearly 93 points of downside movement and closed around the 24,850 level.

Global market analysis

Middle east crisis worsens

The Middle East crisis is deepening due to the ongoing conflict between Israel and Iran, with both sides taking increasingly covert steps.

As the number of casualties rises, the region has become a hotspot. Reports indicate that more than 250 people have been killed in Iran due to the conflict, and on the other side, nearly 20 people have died in Israel following Iran’s strikes.

No ceasefire calls or any kind of peace efforts have come from Iran, according to official data. This is very important and adds more depth to the ongoing analysis. This kind of confidence from Iran appears stronger, as they still haven’t used their advanced weapons against Israel.

If this situation escalates and continues in a sustained manner, it could lead to a serious conflict between the two countries, potentially resulting in a long war.

FED meeting starts today

The discussions on ongoing policies related to inflation and economic liquidity are drawing attention, as today marks the key beginning of the meeting. This is very important because inflation has cooled down over the past couple of months and has come in lower than expected.

This is a very positive sign and could potentially push some Fed members to consider cutting interest rates to make borrowing costs even lower. Meanwhile, the Trump administration is consistently pressuring Fed members to do so.

After consistently raising interest rates to nearly 5.5%, the Fed began its first rate cut in September 2024, 18 months after the tightening cycle began. The last rate cut was made around December 2024.

Since then, the Fed has been holding the interest rate steady due to its ongoing policy stance and the focus on maintaining sufficient liquidity in the market. This approach has been closely monitored, especially as recent data shows that inflation cooled to 2.5% in May. However, this is still above the Fed’s target, which aims to keep inflation below 2%.

Domestic market analysis

Rising crude prices are becoming a concern – Israel - Iran conflict

The Middle East crisis is showing a significant impact on global crude prices. From the Indian perspective, this situation is becoming more concerning. If the conflict between the two countries becomes even more covert and intense, crude prices may rise sharply as a result. If this increase sustains at higher levels, it will put a heavy burden on Indian consumers and the economy.

The government is also working on assessing the potential impact of this situation. If the conflict becomes more severe and continues in the long term, it is important to understand what kind of consequences it might have.

This is a crucial aspect currently being evaluated. Additionally, India has not been importing crude oil from Iran since 2020 — imports have dropped to zero. However, any escalation in the region could still hurt India, especially if oil facilities in Iran or other Middle Eastern countries are affected. In that case, we may see a significant impact on oil supply and prices.

Trade deficit narrows

India’s trade deficit has narrowed to $22 billion, according to recent data from the trade and commerce department. This suggests that both exports and imports have contracted, leading to a lower trade gap. Despite global challenges, exports from India to the U.S. have grown by nearly 17%, highlighting the strong performance of Indian exporters in the U.S. market even amidst tariff pressures.

Previously, data showed that China’s exports to the U.S. had fallen significantly. This shift indicates that India might benefit from rising tariffs on China, especially if a favourable trade deal is struck with the U.S. If that happens, India could gain an edge over China and other emerging economies, making it easier to conduct business with the U.S.

FII AND DII DATA ANALYSIS

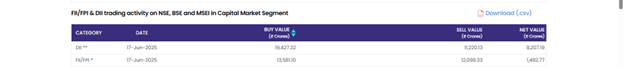

Data analysis shows a strong buying trend today, as FIIs bought nearly ₹1,482 crore. At the same time, DIIs also provided significant support with purchases worth ₹8207 crore in today’s session.

After mixed activity in recent sessions, foreign institutional investors (FIIs) became net buyers in today’s session, June 17, following four consecutive days of selling in Indian equities. They made purchases worth ₹182 crore, marking a positive shift. This is encouraging, especially since the market closed negatively, with the Nifty 50 falling by 90 points.

However, if FII buying increases significantly—around ₹2,000 to ₹3,000 crore—it could provide an additional push for the Nifty 50 to rise and potentially close above the 25,300 level.

Nifty 50 Technical Analysis

The Nifty is approaching a new high around the 25,300 level, and it seems like the index is gradually reaching that price zone. However, if the Middle East crisis escalates faster than expected, along with a surge in crude oil prices—especially Brent crude—it could create headwinds for the market. This situation needs to be monitored carefully.

For now, if Nifty manages to hold and push upward, key support is seen around the 24,500 level. On the upside, resistance lies near 25,200. This is a crucial zone; if the price manages to sustain above it and closes strongly, we could see a new all-time high in the coming months.

Conclusion

There is muted and mixed buying from FIIs, while DIIs are providing sustainable support. The market is struggling to decisively cross the 24,500 level. If this level holds, we are likely to see a range between 24,500 and 25,200. A breakout above 25,200 could open the door for a new rally.

If a trade deal with the U.S. happens and the Fed makes positive comments or moves toward cutting interest rates, it could provide a strong boost to Indian equities. Since returns within the U.S. may become less attractive if the Fed cuts rates, FIIs may look more favourably toward emerging markets like India. As a result, we may see increased FII buying and possibly new highs in the coming months.