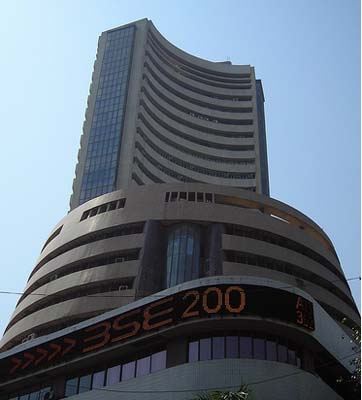

Stock Markets Nervous Ahead Of IIP Data

After opening the day on a positive note, Indian stock markets bend towards the pessimistic zone prior to the IIP numbers to be announced by noon.

After opening the day on a positive note, Indian stock markets bend towards the pessimistic zone prior to the IIP numbers to be announced by noon.

Huge selling pressure was seen across Auto and select telecom scrips.

At 11:54 am (IST), the BSE 30-share Sensex gained 152 points at 15,563, while the NSE Nifty stood at 4,680, up 42 points.

According to Nirmal Bang report, “Intraday support for Nifty exits at 4580, a trade below 4580 can bring little pressure into the system. Resistance is placed at 4650-4690 levels. Fresh buying trigger can be seen only if nifty breaks above the 4700 mark. Weakness can be seen only if Nifty breaks 4550. And major weakness will be seen if markets break 4370/14500 level, until then every dip should be used as a buying opportunity. We believe that at this stage players should stay with the frontline stocks rather then buying midcap.”

The top gainers list included ICICI Bank, L&T, Reliance Industries, L&T, SBI and BHEL. On the other hand, the major losers were HDFC, HUL, Bharti and ONGC.

ONGC’s chairman said on Thursday that the state-run explorer may have suffered a Rs 30 billion revenue loss for selling gas at government-fixed prices during the last fiscal (2008/09).

The company said that it has decided to borrow Rs 270 billion by the next 3 to 4 years for projects of its units. The company may also borrow Rs 50 billion by January to cash in commercial paper, which was used to fund the acquisition of Imperial Energy Plc.

After gaining around 30% during the last three days, shares of Satyam fell by 1% to Rs 80.2. The scrip hit an intra-day high of Rs88.9 and a low of Rs75 and has recorded volumes of over 70 million shares on NSE.

The majority of Asian markets continued their upward momentum on Friday, taking signals from growing commodities prices and hopeful economic news from the US.

For the first time in last three months, U.S. retail sales increased during May 2009, and the number of workers filing new claims for jobless benefits last week hit a January low, furthering expectation that the downturn was abating.

Among the 30-components of Sensex, 18 stocks were trading positively and the remaining 12 were trading in the negative zone.