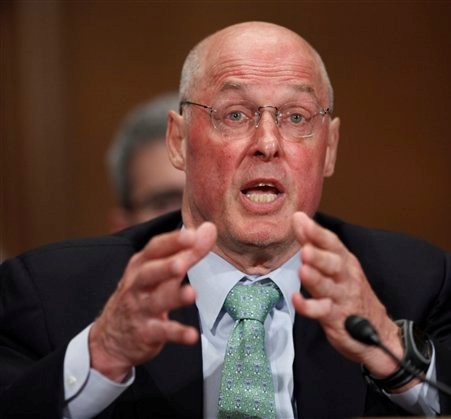

Mistakes were made says former U.S. Treasury Secretary

Official reports have revealed that former U. S. Treasury Secretary Henry Paulson Thursday cautioned against blowing away innovations in the rush to fix the nation's banking system.

Official reports have revealed that former U. S. Treasury Secretary Henry Paulson Thursday cautioned against blowing away innovations in the rush to fix the nation's banking system.

In testimony before the Financial Crisis Inquiry Commission, Paulson said mistakes were made on all levels, public and private, in creating the economic crisis.

Paulson said, "Reforms are unquestionably required," noting that the regulatory system has been "balkanized" to the extent that proper oversight is virtually impossible. Additionally, pressures of a global economy overwhelmed over-leveraged financial institutions.

Paulson further testified, "Many mistakes were made by all market participants, including financial institutions, investors, regulators and the rating agencies, as well as by policymakers."

Paulson called the regulatory system "archaic," and blamed federal mortgage giants Fannie Mae and Freddie Mac for allowing the subprime mortgage crisis and real estate bubble to develop.

He further said, "Like a tainted food scare, a relatively small batch of deadly products, securitized subprime mortgages, led to fear and panic in the markets for many mortgage securitizations, driving down the price of assets, which triggered huge losses and severe liquidity problems," Paulson said. "Derivative contracts, including excessively complex financial products, exacerbated the problem."

Consumers who invested in money markets also were allowed to believe the funds functioned like regular bank accounts, rather than investments that carried a certain amount of risk, Paulson said.

Paulson further added, "The innovations of our modern financial system should be a source of pride. They are expressions of American ingenuity and inventiveness, and they will help secure our rightful place as a leader in the global economy. They also deserve thoughtful scrutiny and appropriate regulation, as they must be well understood and properly used." (With Inputs from Agencies)