MicroStrategy MSTR Stock Price Surges 10 Percent as BTC and Cryptocurrencies Trade Firm

MicroStrategy CEO has been ardent supporter of Bitcoin and as the company is the biggest holder of BTC, the stock price also jumps when cryptocurrency market shows strength. MicroStrategy stock was trading $12 higher at $145 (nearly 10 percent higher). The stock touched intraday high of $145.58. After the US Federal Reserve announced 50 basis points rate cut, cryptocurrencies have jumped. BTC has been trading above 63,000 after a few trading sessions of decline. If BTC holds above this level, we can also see further strength in MSTR stock.

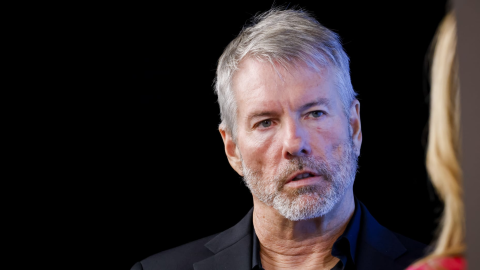

MicroStrategy Inc. continues its aggressive investment in Bitcoin, purchasing $1.11 billion worth of the cryptocurrency between August and September, bringing its total holdings to an impressive 244,800 coins valued at approximately $9.45 billion. Under CEO Michael Saylor's leadership, the company's stock has soared, but investors remain wary of potential risks from Bitcoin’s volatility and regulatory uncertainties. While MicroStrategy's bold strategy aligns it closely with the evolving crypto market, short-term technical indicators suggest that the stock may face a correction before continuing its upward trend. Here’s a closer look at the company’s current trajectory and the challenges ahead.

MicroStrategy’s Bold Bitcoin Accumulation

Relentless Bitcoin Buying Spree: MicroStrategy’s latest purchase of $1.11 billion worth of Bitcoin solidifies its status as the largest corporate holder of the cryptocurrency. The company now owns 244,800 coins, valued at approximately $9.45 billion, positioning itself as a major player in the digital asset space.

Strategic Commitment to Cryptocurrency: CEO Michael Saylor’s unwavering commitment to Bitcoin has redefined MicroStrategy’s business model. Initially a software and cloud services company, it has evolved into a virtual Bitcoin holding firm, using the digital asset as a hedge against inflation and a core part of its financial strategy.

Implications for MicroStrategy’s Stock

Impressive Stock Performance: Saylor’s strategy has propelled MicroStrategy’s stock up 96% year-to-date and 295% over the past year. This significant rise has attracted investor attention, making the stock a popular choice for those looking to gain exposure to Bitcoin without directly holding the asset.

Convertible Bond Financing: To fuel its Bitcoin purchases, MicroStrategy is raising an additional $700 million through convertible bonds, demonstrating the company’s intention to continue its aggressive acquisition strategy. This move reflects Saylor’s confidence in Bitcoin’s long-term potential, despite market volatility.

Risks and Challenges on the Horizon

Volatility and Regulatory Risks: MicroStrategy’s fate is increasingly tied to Bitcoin’s price fluctuations, exposing it to significant volatility. Furthermore, regulatory uncertainties loom as potential challenges, with evolving global policies that could impact Bitcoin and, by extension, MicroStrategy’s stock performance.

Short-Term Technical Concerns: Despite the company’s long-term bullish outlook, technical indicators suggest that the stock may face a period of consolidation. Investors are watching closely to see if MicroStrategy’s momentum can be sustained, or if a near-term correction is on the horizon.

MicroStrategy as a Proxy for Bitcoin

Bitcoin ETFs and Mainstream Adoption: The advent of Bitcoin ETFs could bring more legitimacy and broader acceptance to the asset class, potentially benefiting MicroStrategy’s position. As a de facto proxy for Bitcoin, the company could gain from increased mainstream adoption of the cryptocurrency.

Performance Beyond Bitcoin: Interestingly, MicroStrategy has outperformed Bitcoin itself, which is up 35% for the year. Saylor argues that owning MicroStrategy stock provides investors with unique attributes, such as leverage and downside protection, that direct Bitcoin ownership does not offer.

The Road Ahead for MicroStrategy

Continued Market Influence: As MicroStrategy continues to dominate headlines with its Bitcoin investments, its role in the broader crypto market becomes increasingly significant. The company’s actions not only impact its own stock price but also influence market sentiment around Bitcoin.

Potential for a Stock Correction: While long-term prospects remain positive, MicroStrategy’s short-term outlook suggests the possibility of a pullback. Investors should remain vigilant, balancing the potential upside of Bitcoin’s continued adoption with the inherent risks of market volatility.

MicroStrategy’s ambitious Bitcoin strategy has positioned it at the center of the cryptocurrency market. However, with both opportunities and challenges ahead, the company’s ability to navigate Bitcoin’s volatile landscape will be crucial to its future success.