IT Stocks Makes Recovery as Rupee is looking Weak

In the afternoon trades, the BSE IT index gained 24 points to 4,758.66 owing to the decrease in the rupee values as against the dollar.

In order to tame the rupee, the government had constricted foreign-borrowing rules on 7 August 2007. Now, external commercial borrowings (ECBs) over $20 million have been permissible only for foreign currency expenditure for allowable end-uses and are required to be parked abroad.

During the day, the BSE IT index hit an intraday high of 4,766.37 and an intraday low of 4,572.70. On 19 February, 2007, it touched a 52 -week high of 5,611.33 and a 52- week low of 3,983.83 on 9 August 2006.

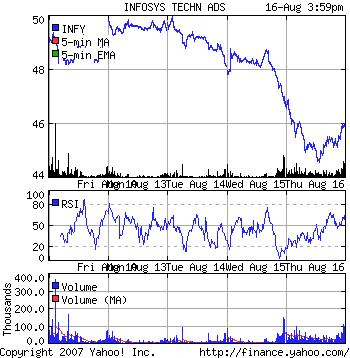

Infosys Technologies gained 0.47% to Rs 1945, while Satyam Computer Services ascended 2.87% to Rs 480.50. TCS dropped 0.78% to Rs 1138.70. Wipro remained flat at Rs 469, off the day’s low of Rs 455. Within the last thirty days to 9 August 2007, the BSE IT index rejected 2.77% as against the Sensex’s increase of 1.27%.

In the BSE IT index, the IT stocks such as Infosys Technologies, Satyam Computer Services, TCS and Wipro have weightages of 49.89%, 15.72%, 11.91%, 7.40% correspondingly.

In the last few months, investor’s response for IT stocks has been sluggish due to the strong rupee. Among Asian currencies, the rupee has been the best performers in this calendar year (2007) thus far.

While declaring Q1 June 2007 outcomes last month, Infosys cut down its FY 2008 earning and revenue guidance in rupee terms because of an increase in the value of rupee against the US dollar. The climbing rupee value straightly impacts the operating margin of IT companies that derive a lion's share of revenue in dollars.