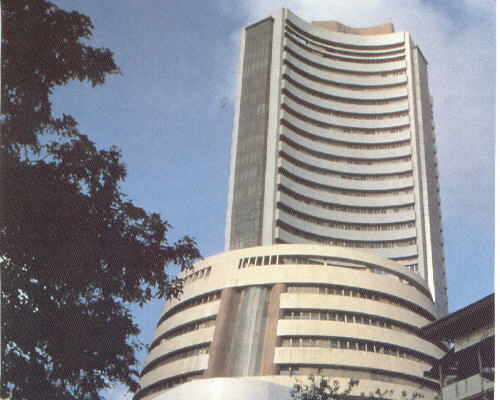

Indian Markets Analyst View: Nirmal Bang Securities

Market ended on a weak note for the second consecutive day on the back of huge sell-off seen in the Asian markets like Shanghai and Hang Seng which ended down 5% and 2.7% respectively. The Sensex ended 158 points lower at 15,173 but at one point the Sensex had lost close to 3 %.

Market ended on a weak note for the second consecutive day on the back of huge sell-off seen in the Asian markets like Shanghai and Hang Seng which ended down 5% and 2.7% respectively. The Sensex ended 158 points lower at 15,173 but at one point the Sensex had lost close to 3 %.

The Nifty fell 50 points to finish at 4,513 but had hit an intraday low of 4,421. All the sectoral indices ended in red barring Oil & Gas and IT. Huge selling was witnessed in realty, banking, metal, power, telecom, capital goods and FMCG stocks. The breadth was negative and the markets recorded highest turnover ever, total turnover increased 39% to Rs 1,47,352 cr. as against Rs 1,05,933 cr. The Aug Nifty future ended with a 10 points premium at 4,523.

Movers & Shakers

The BSE realty index plunged 4.3 % led by decline in HDIL, Omaxe and DLF. The stocks fell over 6.5 % each.

The BSE metal index dropped 2.3 %. Tata Steel, Sterlite were the biggest losers down over 5.3 % each. However, Jindal Steel was up 3.4%. Hindalco and JSW Steel were up 0.5-1.3%

The BSE FMCG index shed 2 %. Nestle, United Spirits, United Breweries, HUL, ITC and Marico declined 1-5.5%.

The capital goods index on the BSE fell 1.7 %. ABB, L&T and BHEL were down 1-4%.

Technology stocks witnessed fresh buying. Stocks like TCS shot up 4.1%, Mphasis up 2.4%, Rolta up 4.3%, Polaris Soft up 8.5%, Hexaware up 3.7% and Wipro up 0.58%. However, Infosys was down 0.55%.

In the Sensex DLF was the top loser down 6.5 % to Rs 398. Tata Steel, Sterlite Ind and Sun Pharma were the other main losers down over 5 % each.

TCS, however, was the biggest gainer in the pack up 4 % to end at Rs 499.