Greaves Cotton Shares Surge Amid IPO Filing of Greaves Electric Mobility

Greaves Cotton’s stock experienced a remarkable 8% surge on Tuesday following the announcement that its electric vehicle (EV) subsidiary, Greaves Electric Mobility Ltd, has filed draft papers with SEBI for a ₹1,000 crore initial public offering (IPO). The IPO comprises a mix of fresh equity issuance and an offer-for-sale (OFS), with proceeds earmarked for technological advancements, manufacturing expansions, and strategic acquisitions. The news has propelled Greaves Cotton to new heights in the stock market, reflecting strong investor optimism about the EV industry and the company’s growth potential. Here’s a comprehensive analysis of the development.

Stock Performance Breaks Records

BSE Movement: Greaves Cotton’s stock rose 7.90%, closing at ₹247.30 after peaking at ₹264, a one-year high during intraday trading.

NSE Gains: On the NSE, the stock registered a 7.36% jump, closing at ₹246.23.

The rally underscores heightened market enthusiasm following the IPO announcement of its EV subsidiary.

Details of the IPO Filing

Fundraising Structure:

Fresh issuance of equity shares worth ₹1,000 crore.

Offer-for-sale (OFS) comprising 18.9 crore shares by existing shareholders.

Promoter and Investor Divestments:

Promoter Greaves Cotton to offload 5.1 crore shares.

Abdul Latif Jameel Green Mobility Solutions DMCC to sell 13.8 crore shares.

The IPO filing with SEBI marks a significant step for Greaves Electric Mobility’s market debut.

Potential Pre-IPO Placement

The company may raise ₹200 crore through a pre-IPO placement.

If undertaken, this will reduce the fresh issuance component of the IPO, optimizing the capital structure.

Utilization of IPO Proceeds

Product and Technology Development: ₹375.2 crore will be allocated to enhance innovation and product development at the Bengaluru Technology Centre.

Battery Assembly Capabilities: ₹82.9 crore will fund in-house battery assembly enhancements.

Manufacturing Capacity Expansion:

₹19.8 crore for Bestway Agencies Pvt Ltd.

₹38.2 crore for MLR Auto Ltd.

₹73.6 crore to increase Greaves Electric’s stake in MLR Auto through acquisitions.

Digitisation and IT Infrastructure: ₹27.8 crore will enhance digital capabilities.

Strategic Growth: Remaining proceeds will support inorganic growth, including acquisitions, and general corporate purposes.

Flagship Brands Fuel EV Market Presence

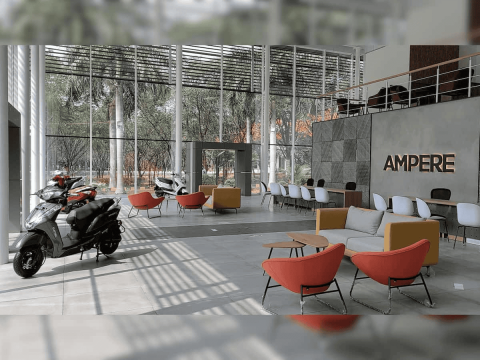

Greaves Electric Mobility is widely recognized for its popular ‘Ampere’ brand of electric scooters.

The company also manufactures three-wheelers under a separate brand, strengthening its diversified EV portfolio.

Investor Sentiment and Industry Outlook

The IPO announcement has reinforced investor confidence in Greaves Electric Mobility’s growth trajectory within the booming EV sector. The company’s focus on innovation, expanded manufacturing, and strategic acquisitions positions it as a formidable player in the Indian EV market. With a robust product pipeline and plans for technological advancements, Greaves Electric is poised to capitalize on rising demand for sustainable mobility solutions. The IPO’s success will be closely watched as a barometer of investor enthusiasm for the future of the EV ecosystem.