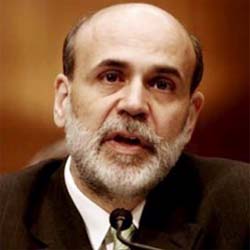

The financial system requires "consolidated supervision," feels Fed Chairman

House Financial Services Committee members were told by U. S. Federal Reserve Chairman Ben Bernanke that the financial system requires "consolidated supervision."

House Financial Services Committee members were told by U. S. Federal Reserve Chairman Ben Bernanke that the financial system requires "consolidated supervision."

The recent recession "made it clear that all financial institutions that are so large and interconnected that their failure could threaten the stability of the financial system … must be subject to strong, consolidated supervision," Bernanke said, with the Senate banking committee poised to debate a 1,336-page regulatory reform bill.

The Fed was just the agency for the job having "developed such expertise in its long experience supervising banks of all sizes, including community banks and regional banks," Bernanke quickly added.

Bernanke further added that supervision of banks and addressing monetary policy are interconnected. "Participation in the oversight of banks … significantly improves its ability to carry out its central banking functions.

He also said, "No other agency can, or is likely to be able to, replicate the breadth and depth of relevant expertise that the Federal Reserve brings to the supervision of large, complex banking organizations." (With Inputs from Agencies)