Crude Daily Commentary for 3.2.09

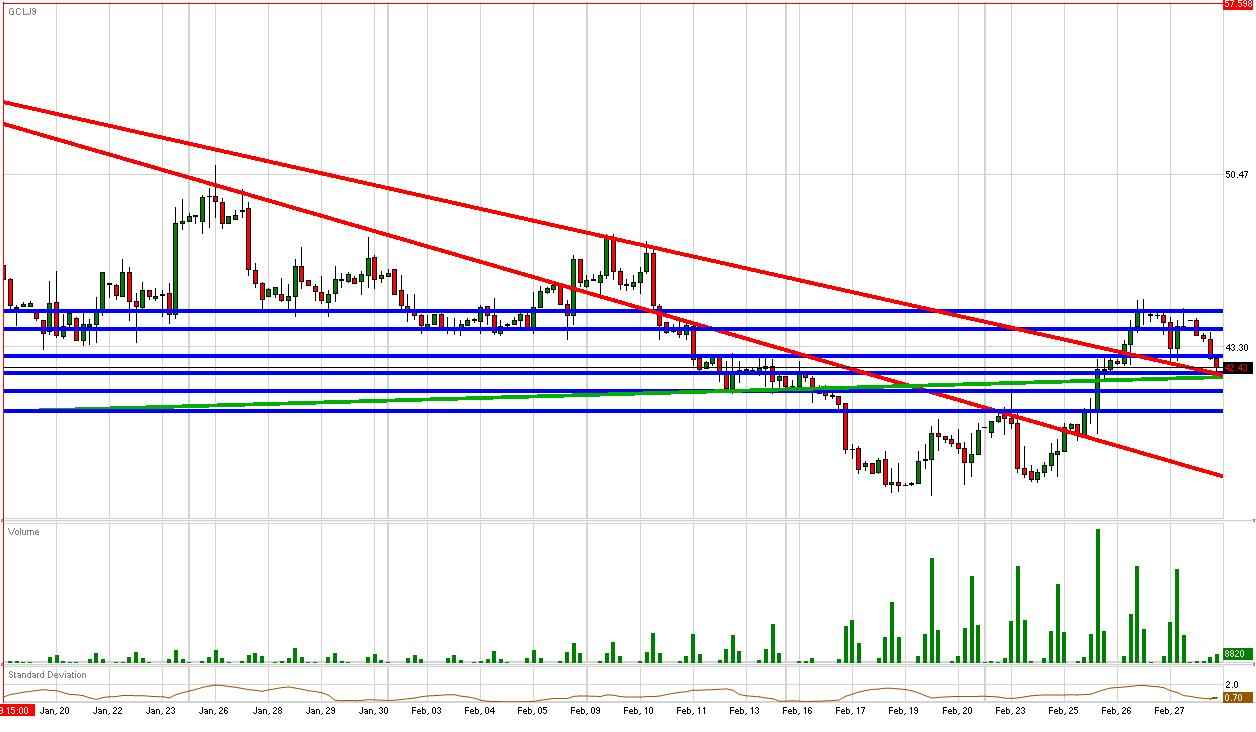

Crude futures are weakening considerably below our uptrend line as U.S. equities look to add onto Friday’s significant losses. With the S&P futures closing below 2008 lows, we anticipate a heightened selloff in equities. Therefore, despite aggressive supply cuts from OPEC, it appears declining demand will have its way with price for the time being.

However, if the price of Crude futures should continue to drop, we wouldn’t be surprised to see OPEC make further cuts in supply to buoy price. As a result, Crude futures could be comparatively stable compared to equities to the downside in the near-term. This stability will depend on Crude Oil Inventories continuing their weekly rise. Crude futures are bouncing off of our 2nd tier downtrend line while remaining above our relatively flat uptrend line.

Fundamentally, we find supports of $42.23/bbl, $41.48/bbl and $40.65/bbl. The $40/bbl area turns into a reliable psychological cushion for the near-term. To the topside, we see resistances of $42.93/bbl, $44.05/bbl and $45.12/bbl. Meanwhile, the $45/bbl area will serve as a psychological barrier. Crude futures are currently trading at $42.68/bbl.

Copyright 2009 FastBrokers, Latest Forex News and Analysis for Forex, Bullion and Commodity Traders.