Eicher Motors Share Price Jumps 1.4 Percent; Bullish Breakout on Technical Charts

Eicher Motors share price closed 1.5 percent higher in today's session. The automotive stock has witnessed a bullish breakout and short term traders can expect further upside in the stock. Eicher Motors opened the trading session at Rs 5,134 and touched an intraday high at Rs 5,224 before closing at Rs 5,190. The stock has offered investors 8 percent return over the last one month.

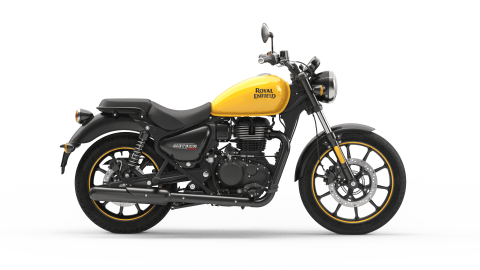

Eicher Motors, a leading player in the Indian automotive sector and the maker of the iconic Royal Enfield motorcycles, continues to draw investor interest due to its consistent performance and growth potential. The stock recently traded between Rs. 5,115.05 and Rs. 5,224.50, with a market capitalization of Rs. 1.43 lakh crore and a Price-to-Earnings (P/E) ratio of 33.38. Despite being near its 52-week high of Rs. 5,385.70, Eicher Motors has shown resilience in its market position, supported by strong demand for premium motorcycles and robust operational efficiency. TopNews team delves into Eicher Motors’ stock performance, technical analysis, and market positioning.

Stock Performance: Key Metrics

| Metric | Value |

|---|---|

| Current Price Range | Rs. 5,115.05 - Rs. 5,224.50 |

| Market Cap | Rs. 1.43 lakh crore |

| Price-to-Earnings (P/E) Ratio | 33.38 |

| Dividend Yield | 0.98% |

| 52-Week High | Rs. 5,385.70 |

| 52-Week Low | Rs. 3,562.45 |

Eicher Motors’ elevated P/E ratio reflects investor confidence in its premium product portfolio and growth trajectory, particularly in the two-wheeler and commercial vehicle segments.

Technical Analysis: Candlestick Patterns

On the daily chart, Eicher Motors has formed a Doji Candlestick Pattern, signaling market indecision. This pattern often indicates a potential reversal or a continuation of the existing trend, depending on subsequent trading sessions.

If the stock sustains above its current levels, it could signal bullish momentum. However, a breakdown below Rs. 5,115.05 might result in further downside, necessitating caution for short-term traders.

Fibonacci Retracement Levels

Using the 52-week high (Rs. 5,385.70) and low (Rs. 3,562.45), the Fibonacci retracement levels for Eicher Motors are as follows:

| Level | Price |

|---|---|

| 0% (52-week low) | Rs. 3,562.45 |

| 23.6% | Rs. 4,054.10 |

| 38.2% | Rs. 4,481.25 |

| 50% | Rs. 4,474.08 |

| 61.8% | Rs. 4,911.50 |

| 100% (52-week high) | Rs. 5,385.70 |

Key Insight:

The stock is trading above the 61.8% retracement level (Rs. 4,911.50), indicating bullish sentiment. A breakout above Rs. 5,385.70 could propel it toward new highs, while support at Rs. 4,911.50 provides a safety net for investors.

Support and Resistance Levels

Support Levels: Rs. 5,115.05, Rs. 4,911.50

Resistance Levels: Rs. 5,224.50, Rs. 5,385.70

Trading Strategy:

A breakout above Rs. 5,224.50 could signal a rally toward its 52-week high of Rs. 5,385.70.

A breakdown below Rs. 5,115.05 may trigger further downside, potentially retesting Rs. 4,911.50.

h3>Analyst Recommendations

ICICI Securities: Issued a "Buy" rating in January 2025 with a target price of Rs. 5,600, citing robust growth in Royal Enfield sales and expanding international operations.

HDFC Securities: Recommended a "Hold" in December 2024 with a target price of Rs. 5,350, highlighting valuation concerns but strong domestic demand.

Actionable Insights and Investment Strategy

Short-Term Traders:

Monitor for a breakout above Rs. 5,224.50 to capitalize on upward momentum.

Use Rs. 5,115.05 as a stop-loss for risk management.

Long-Term Investors:

Accumulate on dips, targeting Rs. 5,600 in the next 6–12 months.

Leverage Eicher’s growth potential in premium motorcycles and international markets for sustained gains.

Risk Factors:

Rising input costs may pressure margins.

Competition from domestic and international players could impact market share.

Bottomline for Traders

Eicher Motors continues to be a dominant force in India’s automotive sector, driven by the success of its Royal Enfield brand and its focus on premium motorcycles. While its elevated P/E ratio reflects market optimism, technical indicators and robust demand trends support its growth story. For both short-term traders and long-term investors, Eicher Motors presents a compelling investment opportunity in India’s evolving automotive landscape.