Crude Daily Commentary for 3.18.09

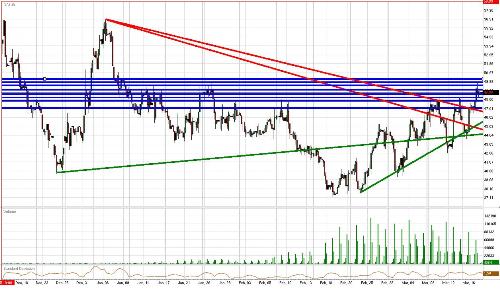

Crude futures continued their impressive climb after jumping above our 2nd tier trend line, but backed away from the highly psychological $50/bbl level as anticipated. January 26 highs are intact for the time being and are the only obstacle, a weak one at that, preventing crude from challenging 2009 highs.

The S&P futures are on a roll, always a strong catalyst to send crude prices higher due to improved expectations concerning production and consequently consumption of energy. However, whether crude rises through $50/bbl and runs towards $55/bbl will depend on the weekly crude oil inventory report coming today.

Despite the flash of encouraging data coming from the U. S., Europe and Asia continue to weaken at an incredible pace. Declining global production coupled with OPEC keeping production rates neutral on March 15 make jumping through $50/bbl all the more challenging.

The medium-term downtrend remains intact and it will take breaking out of 2009 highs to make believers out of us.

Nevertheless, crude futures are well above all of our near-term downtrend and uptrend lines, provided a clear indication that there could be more near-term gains to be realized.

Fundamentally, we find supports of $48.59/bbl, $48.23/bbl, $47.85/bbl, and $47.06/bbl.

To the topside, we see resistances of $49.09/bbl, $49.57/bbl, $49.91/bbl, and $50.28/bbl.

Crude futures are currently trading at $48.78bbl.

Copyright 2009 FastBrokers, Latest Forex News and Analysis for Forex, Bullion and Commodity Traders.

Disclaimer: For information purposes only. FastBrokers assumes no responsibility or liability from gains or losses incurred by the information herein contained. There is a substantial risk of loss in trading futures and foreign exchange.