S&P Daily Commentary for 3.12.09

The S&P futures failed to follow through on Tuesday's rally, seesawing to end the session with slight gains. Investor excitement from Tuesday was tempered by disconcerting economic news from Japan, China, and Germany. Production is grinding to a halt globally, showing the economic crisis continues despite the positive news from Citi. Meanwhile, foreclosures continue to pile up while unemployment rises.

Today's Unemployment Claims release came in at 654,000, topping analyst expectations of 642,000. Furthermore, the previous release was revised upwards to 645,000. On a positive note, retail sales beat analyst expectations today.

However, we should consider how much of the stabilization in retail sales has to do with discounted prices due to declining demand. Ultimately, unemployment trumps retail sales, which could result in profit taking this afternoon. The data surfacing from Germany this week is alarming.

The ECB may need to act quickly or the economic condition in the EU could freefall. It's truly difficult to find many silver linings around the globe. Japan's GDP showed a decline of 3.2% and industrial production in China is echoing the slowdown. However, despite all of the negativity, the S&P still made a strong statement on Tuesday which can't be ignored.

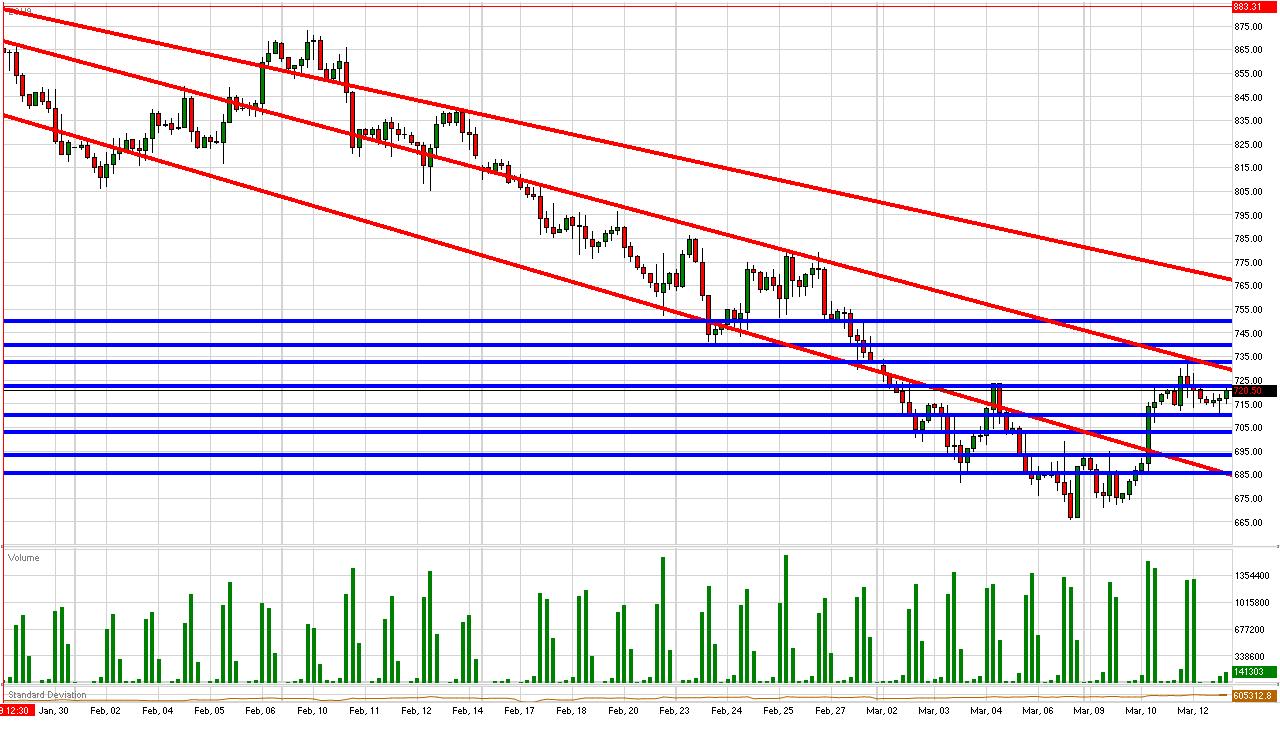

The only question becomes whether Tuesday was a dead cat bounce or the beginning of something more substantial. Since Tuesday's surge was based on positive news from one bank and little else, we are settling on a dead cat bounce until the S&P futures can prove otherwise. The futures still face our 2nd and 3rd tier downtrend lines, not to mention the psychological 800 barrier is a lot further away than the psychological 700 cushion.

Correlation wise, crude futures have posted large losses this week and the 30 Year future logged solid gains yesterday despite an up-day in equities. Additionally, Gold is recovering, showing us the precious metal can continue its uptrend. Hence, the equity correlations still aren't buying a recovery in the S&P. Fundamentally, we maintain our resistance of 722.75 with additional resistances hanging at 732.75, 740, and 750.

The 700 level becomes a key psychological cushion in the near-term. To the downside, we hold our support of 710.25 with additional supports sitting at 703.25, 693.25, and 685.75. The S&P futures are currently trading at 722.00.

Copyright 2009 FastBrokers, Latest Forex News and Analysis for Forex, Bullion and Commodity Traders.

Disclaimer: For information purposes only. FastBrokers assumes no responsibility or liability from gains or losses incurred by the information herein contained. There is a substantial risk of loss in trading futures and foreign exchange.