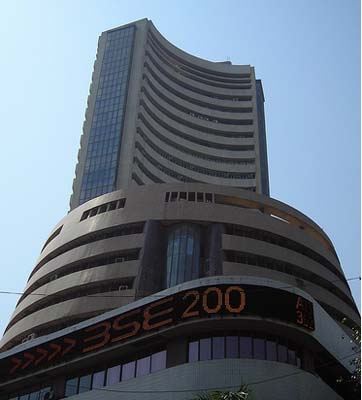

Indian Market View and World Business Review by Nirmal Bang Securities

U. S. stocks fell for a third straight day after Standard & Poor's downgraded the credit ratings of 18 banks, overshadowing gains in health? care shares as Congress prepares legislation to overhaul the industry.

U. S. stocks fell for a third straight day after Standard & Poor's downgraded the credit ratings of 18 banks, overshadowing gains in health? care shares as Congress prepares legislation to overhaul the industry.

President Barack Obama proposed the most sweeping overhaul of the U. S. financial regulatory system in 75 years, seeking to correct a "cascade of mistakes" that toppled major securities firms, froze credit markets and destroyed $26.4 trillion in stock market value around the world.

The proposal, much of which will be subject to approval by Congress, adds an additional layer of regulation for the biggest financial firms. It would create an agency for monitoring consumer financial products, make the Federal Reserve the overseer of companies deemed too big to fail, and bring hedge and private equity funds under federal scrutiny.

Asian stocks declined, dragging the MSCI Asia Pacific Index to a threeweek low, amid concern a rally since March had made stocks too expensive relative to earnings prospects.

Japan's government and central bank agree that the worst of the deepest postwar recession is over.

Demand is picking up even though "the economy is in a difficult situation," the Cabinet Office said in Tokyo yesterday. The Bank of Japan said the world's second? largest economy has "begun to stop worsening."

The World Bank raised its growth forecast for China this year and advised policy makers to delay until 2010 any additional stimulus plan that might be needed to boost the world's third? largest economy. China's economy will expand 7.2 % this year, up from a 6.5 % forecast in March The world Bank said.

The dollar traded near a two? week low against the yen on speculation the Federal Reserve will refrain from raising interest rates because of slower? than? expected inflation. The yen strengthened against 15 of the 16 most? active currencies as a decline in Asian equities spurred demand for safer assets. Fed officials are considering using next week's policy statement to suppress any speculation they're prepared to raise interest rates as soon as this year.

Consumer prices increased 0.1 % in May, after no change in the prior month, the Labor Department reported yesterday. The median forecast of 75 economists surveyed by Bloomberg News was for a 0.3 % increase.