Crude Daily Commentary for 4.2.09

Crude futures are soaring higher from our 1st tier uptrend after weekly inventories came in lower than analyst expectations. Yesterday's improvement in U. S. housing and manufacturing data is exciting the rally as investors shrug off disappointing unemployment numbers.

Of most interest to crude traders was the news that auto sales this month did not decline as much as analysts had feared. Greater incentives and special deals offered by auto retailers are finally attracting new buyers as the U. S. Treasury fights to keep interest rates at a reasonable level.

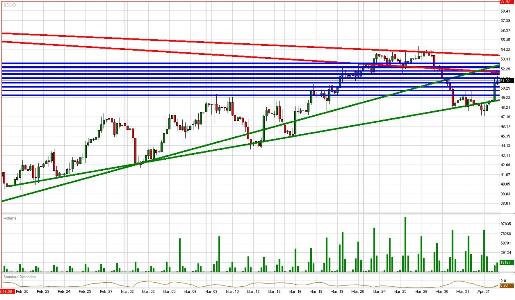

Crude futures catapulted through the psychological $50/bbl without flinching. Therefore, the futures are setting the stage for a massive rally and a reinstatement of the uptrend. The performance of crude will now look to U. S. equities to see if the S&P futures can break through March highs.

If they can, which seems likely at present, crude futures should follow suit to the upside. The next challenge for crude is our 1st tier downtrend line followed by our 2nd tier and 2009 highs. Therefore, crude futures aren't out of the woods.

Now that the futures have made their move, we wouldn't be surprised to see some near-term profit taking and consolidation. In the big picture, rising unemployment should be a cause for concern since it implies less consumption and demand for crude.

However, for the time being, the picture is looking better for crude. Fundamentally, we find resistances of $51.28/bbl, $51.73/bbl, $52.05/bbl, $52.46/bbl and $52.86/bbl.

To the downside, we see supports of $50.80/bbl, $50.38/bbl, $49.97/bbl, and $49.49/bbl. Crude futures are presently trading at $51.04/bbl.

Copyright 2009 FastBrokers, Latest Forex News and Analysis for Forex, Bullion and Commodity Traders.

Disclaimer: For information purposes only. FastBrokers assumes no responsibility or liability from gains or losses incurred by the information herein contained. There is a substantial risk of loss in trading futures and foreign exchange.