Commodity Trading Tips for Nickel by KediaCommodity

Nickel settled down -0.35% at 1097.30 traded in the tight range as the LME market was closed yesterday due to the Bank Holiday in UK. Meanwhile prices are getting support after the news that Jinchuan raised nickel prices by RMB 300/mt, to RMB 125,300/mt, with trader quotes close to Jinchuan’s prices. Russian nickel supply was so tight that transactions were rarely made among traders. Goods were mainly purchased by plants, with prices between RMB 125,000-125,200/mt. While other basemetals dropped as appetite for riskier assets weakened following the release of disappointing Chinese manufacturing data. Data released earlier showed that China’s final HSBC PMI ticked down to 48.1 in April from a preliminary reading of 48.3 and below expectations for a reading of 48.4. The report indicated that China’s manufacturing sector contracted for the fourth consecutive month in April, underlining concerns that an economic slowdown in the world’s second-largest economy is deepening. Meanwhile, market players continued to assess a report showing that the U.S. economy added jobs at the fastest pace in more than two years in April, but also showed weaker earnings growth and a drop in labor force participation. Investors continued to monitor events in Ukraine, as hostilities between Kiev and Russia remain high. Clashes between Ukraine's army and pro-Russian forces broke out in six cities in eastern Ukraine over the weekend, stoking fears that the crisis will develop and drag the U.S. deeper into the standoff. Technically market is under fresh selling and getting support at 1093.6 and below same could see a test of 1089.9 level, And resistance is now likely to be seen at 1100.9, a move above could see prices testing 1104.5.

Nickel settled down -0.35% at 1097.30 traded in the tight range as the LME market was closed yesterday due to the Bank Holiday in UK. Meanwhile prices are getting support after the news that Jinchuan raised nickel prices by RMB 300/mt, to RMB 125,300/mt, with trader quotes close to Jinchuan’s prices. Russian nickel supply was so tight that transactions were rarely made among traders. Goods were mainly purchased by plants, with prices between RMB 125,000-125,200/mt. While other basemetals dropped as appetite for riskier assets weakened following the release of disappointing Chinese manufacturing data. Data released earlier showed that China’s final HSBC PMI ticked down to 48.1 in April from a preliminary reading of 48.3 and below expectations for a reading of 48.4. The report indicated that China’s manufacturing sector contracted for the fourth consecutive month in April, underlining concerns that an economic slowdown in the world’s second-largest economy is deepening. Meanwhile, market players continued to assess a report showing that the U.S. economy added jobs at the fastest pace in more than two years in April, but also showed weaker earnings growth and a drop in labor force participation. Investors continued to monitor events in Ukraine, as hostilities between Kiev and Russia remain high. Clashes between Ukraine's army and pro-Russian forces broke out in six cities in eastern Ukraine over the weekend, stoking fears that the crisis will develop and drag the U.S. deeper into the standoff. Technically market is under fresh selling and getting support at 1093.6 and below same could see a test of 1089.9 level, And resistance is now likely to be seen at 1100.9, a move above could see prices testing 1104.5.

Trading Ideas:

Nickel trading range for the day is 1089.9-1104.5.

Nickel dropped on concern that demand will ebb after a report showed manufacturing increased less than expected in China

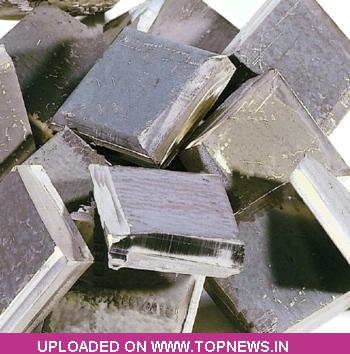

Physical supply of nickel has stabilised in Europe as consumers slowed a burst of stockpiling triggered by fears an Indonesian export ban would make ore scarce.

A ban on unprocessed ore exports from top producer Indonesia in mid-January sparked concerns of a shortage of the raw material.