Commodity Outlook for Silver by KediaCommodity

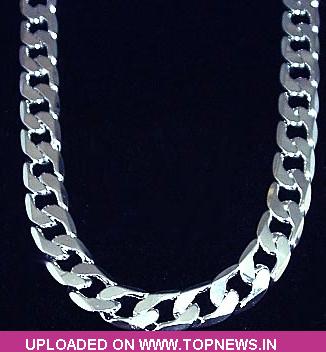

Silver ended flat after falling over 3 percent from highs on profit booking. Silver market was vulnerable to some type of profit taking or technical correction due to that very significant run in a very short period of time. Earlier in the day silver rose to record highs as fears over falling currencies and euro-zone debt contagion send investors looking for alternative assets. The gray metal surged in a broad-based rally across the commodity markets, which also sent gold to new records and crude oil futures to their highest in 26 months. Now technically market is trading in the range as RSI for 18days is currently indicating 70.79, where as 50DMA is at 39200.94 and silver is trading above the same and getting support at 44030 and below could see a test of 43497 level, And resistance is now likely to be seen at 45415, a move above could see prices testing 46267.

Silver ended flat after falling over 3 percent from highs on profit booking. Silver market was vulnerable to some type of profit taking or technical correction due to that very significant run in a very short period of time. Earlier in the day silver rose to record highs as fears over falling currencies and euro-zone debt contagion send investors looking for alternative assets. The gray metal surged in a broad-based rally across the commodity markets, which also sent gold to new records and crude oil futures to their highest in 26 months. Now technically market is trading in the range as RSI for 18days is currently indicating 70.79, where as 50DMA is at 39200.94 and silver is trading above the same and getting support at 44030 and below could see a test of 43497 level, And resistance is now likely to be seen at 45415, a move above could see prices testing 46267.

Trading Ideas:

Silver trading range is 43497-46267.

Silver ended flat after falling over 3 percent from highs on profit booking

Silver is having resistance at 44800 and support at 44300 level.

Holdings at ishares silver trust rose by 124.65 tonnes to 10941.34 tonnes