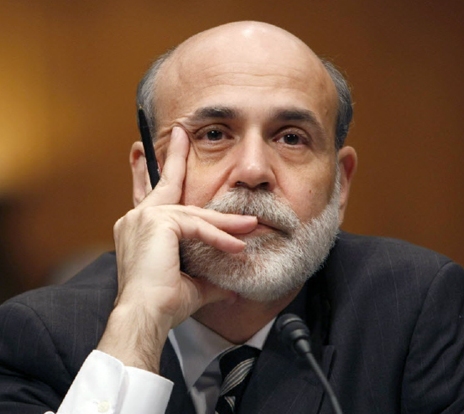

U.S. Federal Reserve Chairman lauds the bank stress tests

According to the reports, U. S. Federal Reserve Chairman Ben Bernanke lauded the bank stress tests the government conducted a month ago on the nation's 19 largest banks.

According to the reports, U. S. Federal Reserve Chairman Ben Bernanke lauded the bank stress tests the government conducted a month ago on the nation's 19 largest banks.

The "unprecedented" tests that reviewed two-thirds of the country's bank assets using a grouping of the largest banks restored confidence in the banking system, Bernanke said in a speech in Chicago at the 46th Annual Conference on Bank Structure and Competition.

It was further reported that the tests were conducted a year ago, seven months after the collapse of Lehman Brothers, giving the public a focused look at the health of the 19 banks, which including Bank of America, Citigroup, Wells Fargo & Co., Goldman Sachs and others.

He said, "Nearly all of the … (tested) firms that were judged to need additional capital were able to raise that capital in the public markets … and most of the 19 institutions have repaid the government capital that had been injected during the crisis."

He further added that Logistics prevented the Fed from conducting "full-scale simultaneous stress test" of the rest of the Nation's banks.

It was also reported that Bernanke pushed for regulatory reform, but he did not single out any specifics, except to say, "We need a strong resolution framework that allows policymakers to wind down failing, systemically important financial institutions without a destabilizing bankruptcy and without a taxpayer bailout." (With Inputs from Agencies)