Trade Setup for 30 June; NSE Nifty Eyes All-time High as Trade Deal with USA Could Be Announced Soon

The Indian stock market continues to show impressive strength, with Nifty 50 repeatedly hitting new highs and maintaining a sustainable upward trend. Nifty has surged from 24,500 to 25,637 in a rapid and powerful move, reflecting strong investor confidence.

This momentum has been supported by both positive global cues and substantial buying activity from institutional investors, including Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs).

Stock Market News Analysis

Bangladesh’s Payment to Adani: Positive Signal for Indian Companies

One notable development is Bangladesh’s payment of ₹384 million to Adani for overdue electricity bills. Adani’s electricity supply is crucial for Bangladesh’s power needs. However, following a coup in Bangladesh, the payment was delayed despite repeated reminders from Adani. After the company cut off power supply and issued warnings about further consequences, Bangladesh settled the dues. This resolution has strengthened investor confidence in Adani Group companies, highlighting the importance of geopolitical events in shaping corporate revenues and market sentiment.

Geopolitical Developments Support Positive Sentiment

Global news continues to fuel market optimism. Reports indicate potential discussions between the US and Iran regarding Iran’s nuclear program. Although Iran’s supreme leader denied any ongoing negotiations and asserted victory over the US in a state TV address, the avoidance of immediate conflict has reduced market fears of escalation.

Similarly, US-Russia relations have seen encouraging signs. Russian President Vladimir Putin praised the stabilization of ties between the two countries and expressed interest in meeting with former US President Donald Trump. Although previous tensions, including failures in the Russia-Ukraine ceasefire, strained relations, these recent statements suggest progress. A thaw in US-Russia relations is viewed positively by markets, as reduced geopolitical risk can support global economic stability.

NATO Defense Spending: Opportunities and Risks

Another significant development came from NATO’s recent meeting, where key member countries agreed to increase defense spending to nearly 5% of their GDP. This substantial commitment aims to strengthen NATO’s security posture in response to rising geopolitical challenges. While this move is expected to benefit defense companies through increased orders and revenues, it also raises concerns about potential arms races and heightened global tensions. Investors should watch the defense sector closely, as it is likely to see significant inflows and volatility in the coming months.

US-China and Potential India-US Trade Deals

Trade developments are also driving markets higher. US President Trump recently announced the signing of a deal with China, which has boosted investor sentiment worldwide. He further hinted that a major trade deal with India could happen soon, fueling optimism in Indian equities.

If India secures a favorable deal with the US, it could open up new opportunities for exports, technology transfers, and economic growth, which would be highly supportive for Nifty 50 and broader markets.

FII and DII Activity: Sustaining the Uptrend

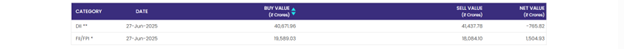

Strong institutional flows continue to underpin Nifty’s momentum. On June 27, net FII buying reached ₹1,397 crore, adding to the robust buying earlier in the month. On June 20 alone, FIIs bought more than ₹12,000 crore worth of Indian equities, making them net positive buyers for June. Meanwhile, DIIs recorded slight net selling of around ₹588 crore, but this is modest compared to the significant FII inflows.

These consistent institutional activities highlight sustained confidence in the Indian market, supporting the view that the current rally has a strong foundation.

Nifty 20 technical Analysis & Key Levels

From a technical perspective, the Nifty 50’s trend remains decisively bullish. The index is benefiting from positive institutional flows and supportive economic news, including the recent 50 basis point repo rate cut by the Reserve Bank of India, which has improved liquidity conditions and investor sentiment.

Resistance: Nifty’s next major resistance and potential new all-time high is projected around 26,300. A decisive breakout above this level could open the path for further gains.

Support: Strong support is seen near 25,300, which has acted as a base during recent consolidations. Maintaining this support will be key for sustaining the uptrend.

Currently, the market shows no major resistance levels before 26,300, suggesting a clear path for upward movement if positive news continues.

Conclusion

In summary, a combination of positive geopolitical developments, strong institutional buying, Bangladesh’s payment to Adani, and optimism around a potential India-US trade deal are fueling Nifty 50’s sustainable rally. Should these favorable trends continue, Nifty could soon reach or even surpass its projected all-time high near 26,300. Investors should stay alert to global news, institutional activity, and technical levels, as these factors will be critical in determining the next big move in Indian equities. Overall, the outlook remains bullish, with the potential for significant gains if supportive catalysts materialize.