Trade Setup for 23 May; Nifty range 24600-25000, US Tax Cut Bill Cleared and MOODY’s Positive Outlook on India

Following global cues and technical factors, along with continued FII selling pressure, the market is being pushed to lower levels. Today, the market fell by nearly 203 points and closed near the 24,469 level. As we discussed earlier, the 24,600 level is expected to act as strong support due to the presence of a bullish candlestick pattern.

The market opened slightly higher but then fell nearly 200 points. Throughout the day, it showed slight fluctuations with a sideways movement, making a low of 24,462. However, by the end of the day, it made a sharp recovery of around 155 points and closed near the 24,600 level.

Global Market Analysis

Jamie Dimon on FED policy and stagflation risk

Jamie Dimon made a statement highlighting a significant concern in the U.S. economy — the possibility of a stagflation scenario due to ongoing inflation and related issues. He mentioned that policymakers are currently holding off on major decisions, awaiting future developments. If stagflation does occur in the U.S., it could lead to higher prices, increased unemployment, and further strain the economy, ultimately resulting in slower growth.

US passes Trump Administration Tax Cut Bill

The U.S. has recently passed a significant bill. In this bill, Republicans in the U.S. Congress are advancing sweeping budget packages aimed at fulfilling President Donald Trump's goals of cutting taxes and reducing spending. Further details related to this matter have not yet been disclosed. The bill was passed in Congress with 214 to 215 votes.

This was also one of the promises made by President Trump during his campaign, where he pledged to reduce taxes. How this move will impact the U.S. economy remains to be seen in the coming times.

US Put Remittances Tax

The U.S. is expected to propose a tax that would apply globally to individuals earning money in the U.S. and sending it abroad. This proposal includes an additional 5% tax on such remittances. India, being one of the largest recipients of remittances in the world, with a significant portion coming from the U.S., could be directly impacted by this move.

Although the bill has not yet been passed, it is expected to be introduced in Congress soon and may become law. If it does, it would be a negative development for India, especially for Indian workers abroad, as it could reduce the amount of money sent back home.

Domestic Market Analysis

Nifty defense sector on rise

The rally in the defence sector has not yet ended, as the sector continued its upward momentum and recorded nearly 2% growth today. The Nifty India Defence Index closed near its all-time high of 8,555, having touched an intraday high of 8,453. This marks significant progress for the sector.

Following the successful Operation Sindoor, there is a strong possibility that India will strengthen its defence capabilities, especially with the push for indigenous defence production under the 'Make in India' initiative. This operation highlights the growing importance and performance of the Indian defence sector.

Several countries are showing interest in India's indigenously made defence equipment, particularly the BrahMos missile, which played a key role in recent operations by delivering precise and effective strikes. This marks a significant development for India's defence exports. A few South Asian countries, including Vietnam and the Philippines, have shown strong interest and made progress in discussions to acquire such advanced systems, highlighting India's growing influence in the global defence market.

Moody's on India's Position in Tariffs and Trade Disruptions

Recently, Moody's stated that India is well-positioned compared to other countries when it comes to handling U.S. tariffs and global trade disruptions. The report highlighted several key factors, including India's relatively low dependency on U.S. trade.

Additionally, Moody's noted that inflation in India is expected to remain under control in the near term. This controlled inflation environment opens the door for potential rate cuts to support economic growth. Overall, Moody’s expressed confidence in India’s ability to navigate global trade challenges effectively.

Market mixed reaction – FII selling, covid case in India

The market is showing a mixed reaction due to several ongoing developments. FII selling, concerns around COVID, and a lack of strong movement from major sectors have contributed to the uncertainty. Over the past few days, FIIs have turned net sellers, offloading a significant amount this week, which has led to continued downward pressure on the Nifty.

Despite this, some developments in Singapore and Hong Kong could influence sentiment slightly, though much of the significant data seems to have already been priced in. Overall, these mixed factors are keeping the market in a volatile state.

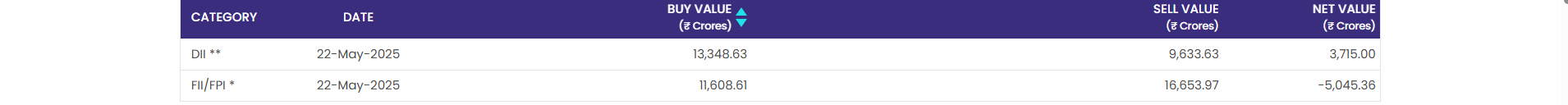

FII and DII Data Analysis

In recent times, FIIs have turned into net sellers in the Indian equity market. Today alone, they sold nearly ₹5,000 crore worth of equities. In contrast, DIIs emerged as net buyers, purchasing equities worth approximately ₹3,715 crore. So far this week, FIIs have sold nearly ₹10,000 crore, making them the biggest net sellers of the week. Today's heavy selling further solidifies their position as the most aggressive sellers in recent sessions.

If we compare the current data with the previous month, FIIs are still net buyers in the month of May, with a net inflow of around ₹10,000 crore into the Indian equity market. This is a very significant figure and one of the highest in the past few months. This strong inflow helped push the Nifty to higher levels. The upcoming week will be crucial in determining how FIIs continue to contribute to the Indian equity market and whether they maintain or reverse their recent selling trend.

Nifty 50 Technical Analysis Outlook

As mentioned in previous blogs, the 24,600 level has been highlighted as a major support for Nifty. Over the past few days, Nifty has managed to hold above this level without closing below it. However, today we saw a dip below this support, with the index touching a low near 24,450. Despite this intraday weakness, Nifty managed to close above the crucial 24,600 mark, which is a significant and positive sign from a technical perspective.

If you take a closer look, Nifty has formed a weak-type candle that indicates demand at the 24,600 level. This suggests buying interest is emerging at this support zone. The upcoming trade setup will be crucial, as this level could potentially trigger a strong bounce back in Nifty, possibly leading to a new high in the near term. As of now, the support at 24,600 remains intact, while the resistance is seen around the 25,000 mark. These levels will play a key role in determining the next directional move for the index.

Conclusion

Nifty has experienced a sharp fall in recent sessions, but there doesn’t appear to be strong conviction behind the decline. It seems more like a technically driven correction, with both FII selling and market sentiment playing a role. Today’s price action and the strong buying near the 24,500–24,600 zone suggest that this level could act as a solid support.

If this support holds, we may see a strong bounce in the coming sessions, potentially pushing Nifty to higher levels. However, if Nifty closes below the 24,500 mark in the next couple of sessions, it could signal a shift towards a more choppy or bearish trend. For now, the current setup indicates the potential for an upside move, but the 24,500 level remains the key to watch.