Trade Setup for 16 May; NSE Nifty Faces Resistance at 25,200, Trump Talks about Apple’s Production Changes and Overall US Economy

As we analysed for the previous session, Nifty was eyeing the 25,000 level, but it was unexpected that it would gain 400 points in a single day, not only crossing this level but also closing significantly higher at around 25,062. There are a few factors driving this strong momentum, such as the consistent activity of FIIs and a positive global sentiment, both contributing to the rally in the Nifty 50. Today, the market opened flat, then moved nearly 100 points down from its opening level.

Later, in the middle of the day, the market showed strong momentum, reaching a high around the 25,100 level. It’s a very positive sign, as the market also closed near its high, indicating the potential for continued strong movement.

Global Market Analysis

Russia and Ukraine Ceasefire Talks

Various reports have emerged regarding the ceasefire talks, indicating that the Presidents of Russia and Ukraine are expected to meet in Turkey to discuss a possible ceasefire. However, some reports suggest that Russia may send a lower-level official instead of President Putin himself.

Additionally, it has been reported that the West has set a precondition for the talks, demanding a 30-day ceasefire on the ground before initiating discussions with President Zelensky.

This suggests that the ceasefire may not take place until the talks actually begin. There are also expected updates which could play a key role in shaping the progress of the ceasefire.

Investment in the U.S. Economy

The U.S. market has been showing a strong upward movement in recent days, driven by increased investment efforts supported by the U.S. administration. During President Donald Trump’s visit to the Middle East, today’s news reported that Qatar is planning to invest nearly $200 billion in Boeing. This represents a very significant deal for Boeing and is also a major part of the ongoing investments flowing into the U.S. economy.

Previously, several major commitments were also made by companies like NVIDIA, OpenAI, and SoftBank, along with other major firms, indicating their plans to invest heavily in the U.S. economy in the near future. Additionally, the possibility of a global trade war is emerging.

All these factors are collectively supporting the strength of the U.S. economy and driving the NASDAQ higher. Finalizing deals with various countries is also having a significant impact, further boosting the NASDAQ, which has already shown strong movement due to these ongoing developments.

Domestic market analysis

Trump on Zero Tariffs from India

This news has received a neutral reaction from the market, as there hasn’t been any final declaration regarding the tariff discussions. The market is unlikely to react strongly until a clear announcement is made. President Trump has previously made several statements on this topic, but actual developments are still pending.

If India agrees to offer zero tariffs to the U.S., the key question remains—what will India gain in return? This outcome could have a significant impact, which will be reflected in the market sentiment.

Nifty IT in Focus

Nifty IT is currently in focus due to the strong and progressive growth of the U.S. economy, driven by lower inflation data and upcoming large-scale investments. This has brought renewed attention to the IT sector.

Additionally, several AI-related investments are taking place, and Indian IT companies have given positive forecasts for their AI business in the U.S. As a result, Nifty IT is showing strong movement. Reports also suggest that Nifty IT has received a major boost due to easing inflation and recession concerns, especially following trade deals with major global economies.

Trump on Apple Production in India

Following the trade war with China, it is anticipated that the U.S. may impose lower tariffs on Chinese goods after finalizing a trade deal. However, these tariffs are still expected to be relatively higher compared to those on Indian goods.

In response to these developments, Tim Cook announced in the recent quarterly earnings that a significant portion of iPhone production for the U.S. market will shift to India. In reaction to this, former President Trump stated that iPhones intended for American consumers should be manufactured in the U.S. He reportedly conveyed the same message directly to Tim Cook.

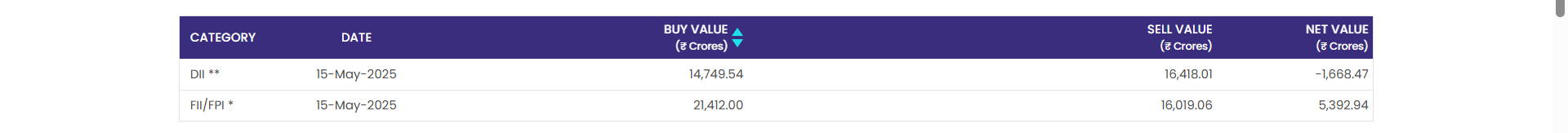

FII and DII activity analysis

FII and DII activity analysis shows that the Nifty 50 made nearly a 400-point movement today, and there was no major impactful news. Obviously, continuous buying by FIIs is taking place, and today the market anticipates that FIIs will be strong buyers, as the Nifty has moved nearly 400 points.

According to the data, FIIs made one of the highest purchases in today’s trade setup, buying ₹5,392 crore in the cash market, while also selling around ₹1,668.47 crore. This recent growth by FIIs is contributing positively to the Nifty 50, as the global cues for the Indian stock market remain positive and accurate.

When it comes to selling in the previous month, FIIs sold massively, but their buying was not significant. So far this month, FIIs have bought nearly ₹15,000 crore in May, and 15 days have passed. However, the selling was around ₹60,000 to ₹90,000 crore on a monthly basis. By analyzing this, we can expect there is good room for FIIs to increase their buying. If things become clearer, we might see strong buying from FIIs, which could push the market even higher.

Nifty 50 outlook for tomorrow’s trade setup

As we analyzed in the previous vlog, the 25,000 level is expected to be a strong resistance, while 24,600 is a key support. However, today’s market showed an impressive move by smoothly holding the 24,600 level as support and also breaking above the 24,000 resistances, closing above that level. Now, because of this, the 24,000 level has become a support, and the 25,000 level will act as resistance for the day.

There is also a hint that in December, the swing was near the 24,900 level, which was crossed by two types of candles. In today’s trade setup, the daily candles of the Nifty 50 closed near the high, indicating strength in the movement and the possibility of further upside. If the FII buying continues along these lines, we may see positive momentum and higher levels for the Nifty 50. Looking at support and resistance, the current support is around 24,600, and the resistance is near 25,250 levels.

Conclusion

FIIs bought more than ₹5,000 crore in today’s cash market, which is significant. Additionally, we have strong global cues, especially toward the end of the session. What stands out is that Nifty is showing strong upward momentum.

Now, the key factors to watch are how trade deals and discussions with the U.S. unfold. Another important point is that if FIIs continue buying in the range of ₹4,000–₹6,000 crore in the Indian equity market, that alone could be enough to push the market higher. However, if their buying slows down to ₹1,500–₹2,000 crore, we might see more volatile, two-sided market movement.

These are the scenarios to keep an eye on. Let’s see how FIIs proceed and how the trade deals develop. For now, the key resistance is around 25,250, and the support remains near 24,600.