Trade Setup For 14 May; NSE Nifty 24,600 Strong Support, JP Morgan lower the Recession Chances, Nifty PHARMA on Rise

After making a robust move yesterday, the market corrected that movement today. Yesterday, the market surged by more than 900 points in a flush. Today, the market opened nearly flat and initially attempted to extend the gains.

However, it experienced a sharp decline. Midway through the day, the market tried to bounce back but eventually closed at 24,578, ending nearly 350 points down.

We talked about the 24,600 level as a resistance, which has now turned into support, as the market made a strong closing near the high yesterday. Today, this level acted as support again, with the price closing near 24,600. This makes us curious to see how the market will react in the upcoming trade setup."

Global Market Analysis

JP Morgan's Prediction on the U.S. Decision

In the previous report, JP Morgan had increased the probability of a recession in the U.S. economy, expressing concern about reciprocal trade tensions globally. However, a recent trade deal with the UK—marking the first reciprocal agreement signed by the U.S.—along with positive developments in trade relations with China, has led them to lower their recession prediction to below 50%.

This is a positive sign. Additionally, reports suggest that upcoming trade moves could help reduce interest rates, which further increases curiosity and optimism about the future of the U.S. market.

Since companies like Infosys and the entire IT sector are heavily dependent on the U.S. economy, they are also being impacted by these developments. Reports like these could bring positive sentiment for such companies and the overall IT sector, potentially leading to a good bounce in the coming times."

U.S.–China Trade War Update

Yesterday, a major development emerged regarding the U.S.–China trade war. Both countries have reached a short-term agreement aimed at reducing tariffs. China has lowered tariffs to just 10% on U.S. products, while the U.S. has reduced its import tariffs on Chinese goods to 30%. While this appears to be a positive step forward, it is more of a temporary pause than a full resolution.

This pause is significant, as the way future negotiations unfold between the U.S. and China will be crucial. There are several conditions and complexities involved. Moreover, the Trump administration, through a statement on Truth Social, emphasized that at least 80% tariffs should be maintained on Chinese goods.

How these developments impact the U.S. economy—and the global economy—remains to be seen.

Domestic Market Analysis

Nifty pharma on focus

Yesterday, in a statement from U.S. President Trump on the Truth Social app, it was announced that the U.S. will lower tariffs on drugs and pharmaceutical products to help reduce hospital bills for American consumers.

Since India has a strong pharmaceutical business presence in the U.S., with several companies generating 50% to 60% of their revenue from the American market, this development is highly significant for them. It presents a good opportunity for these companies. This positive news was also reflected in today's market — Nifty Pharma rose by approximately 1.22%, while the Nifty 50 declined by around 1.40%.

India's Operation Killer

After successfully completing Operation Sindoor, India has recently announced a new mission titled Operation Killer. Under this operation, the Indian Armed Forces aim to eliminate terrorists. According to today’s reports, nearly three terrorists have been neutralized by the forces.

These developments indicate that Pakistan's response to the fight against terrorism is not serious. This is not a good sign for India. Additionally, the stock market has not reacted positively, and there is no significant movement expected solely due to this operation.

However, it does highlight how such incidents might one day lead to a strong response from India.

Reports are also emerging that India has revised its nuclear doctrine, stating that if a terrorist attack is carried out on Indian soil, it will be considered a military attack by Pakistan. This marks a major shift in India’s foreign policy regarding warfare and is of great significance.

PM Modi address to the nation

PM Modi addressed the nation yesterday. His speech covered various aspects, including the Pahalgam attacks, Operation Sindoor, and the terrorist attacks carried out by the Pakistani military. All of these topics were discussed.

This had an impact, as PM Modi also stated that the Indian self-made defense equipment made a significant contribution. As a result, most defence stocks saw a strong rebound today. For example, HAL rose by 3.83%, and other defence stocks were also trading higher.

FII and DII Analysis

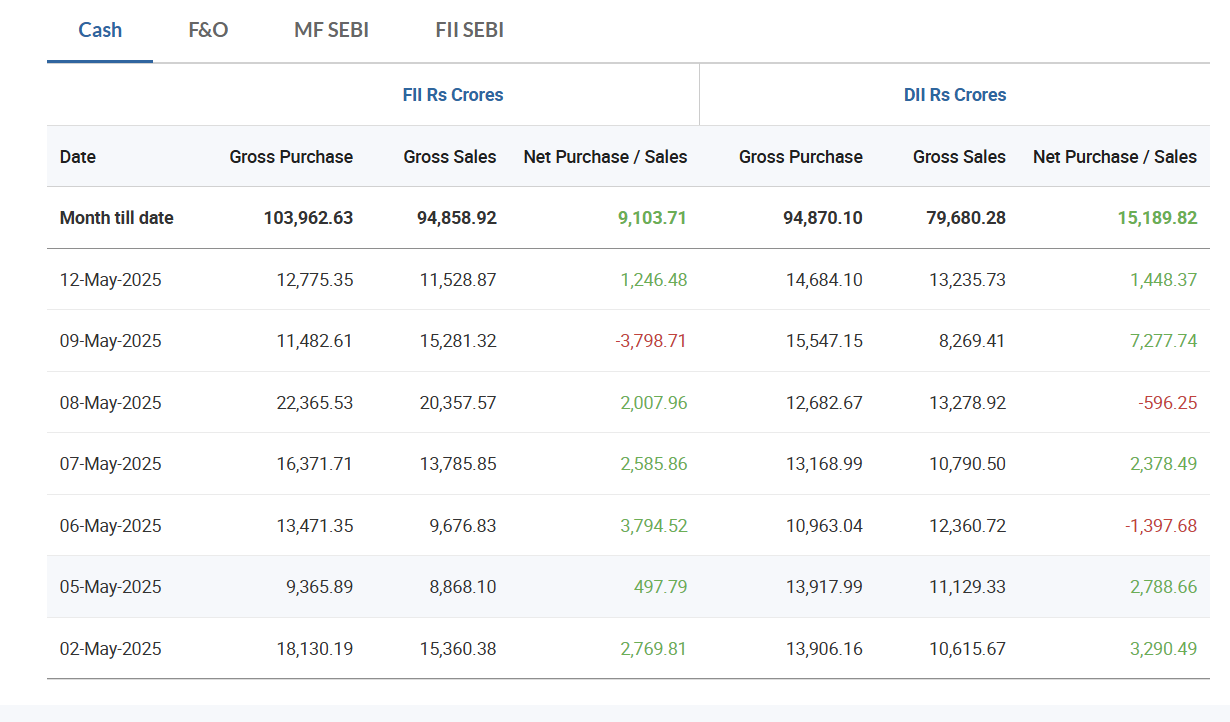

FIIs have returned to buying activity. Yesterday, FIIs made purchases worth approximately ₹1,246 crore in the cash market, marking a strong comeback. This is significant because, in Friday's trade setup, FIIs had turned net sellers for the first time in May.

However, in Monday’s session, they resumed buying, which is a positive signal. FIIs are now supporting the market's upward momentum and contributing to a bullish trend. Similarly, DIIs are also showing support, aiding the continued upward movement of the Nifty 50 index.

Nifty 50 Outlook for Tomorrow's Trade Setup:

From a technical analysis perspective, Nifty 50 is showing positive signs. The 24,600 level is expected to act as strong support, with a suggested stop-loss at the previous day’s opening level of 24,420. This support zone will be crucial for the upcoming session. On the upside, it's also important to watch out for key resistance levels to assess the potential for further upward movement.

To analyze the resistance, the 25,000 level stands out as a key near-term resistance. This level was tested both yesterday and today, and it also marks the swing high made back in December 2024. These factors make it a very significant level to watch. If FIIs continue their buying momentum and U.S. tariff pressures ease, there’s a strong possibility that this resistance could be broken sooner than expected.

Conclusion

Robust and continuous buying by FIIs is providing strong support to the market. The global environment is also showing positive signs, with ceasefire developments and easing of the U.S.–China tariff tensions, as negotiations are underway. The IT sector is witnessing a rise, and the defence sector is gaining momentum following recent approvals and developments. Additionally, Nifty Pharma is likely to benefit from the U.S. decision to lower taxes on drugs, which could positively impact the sector.

Overall, these factors are contributing to a stable and upward trend in the market. If FIIs continue their buying in Indian equities and no major geopolitical uncertainty arises between India and Pakistan, we can expect Nifty 50 to move higher than current expectations in the coming sessions.