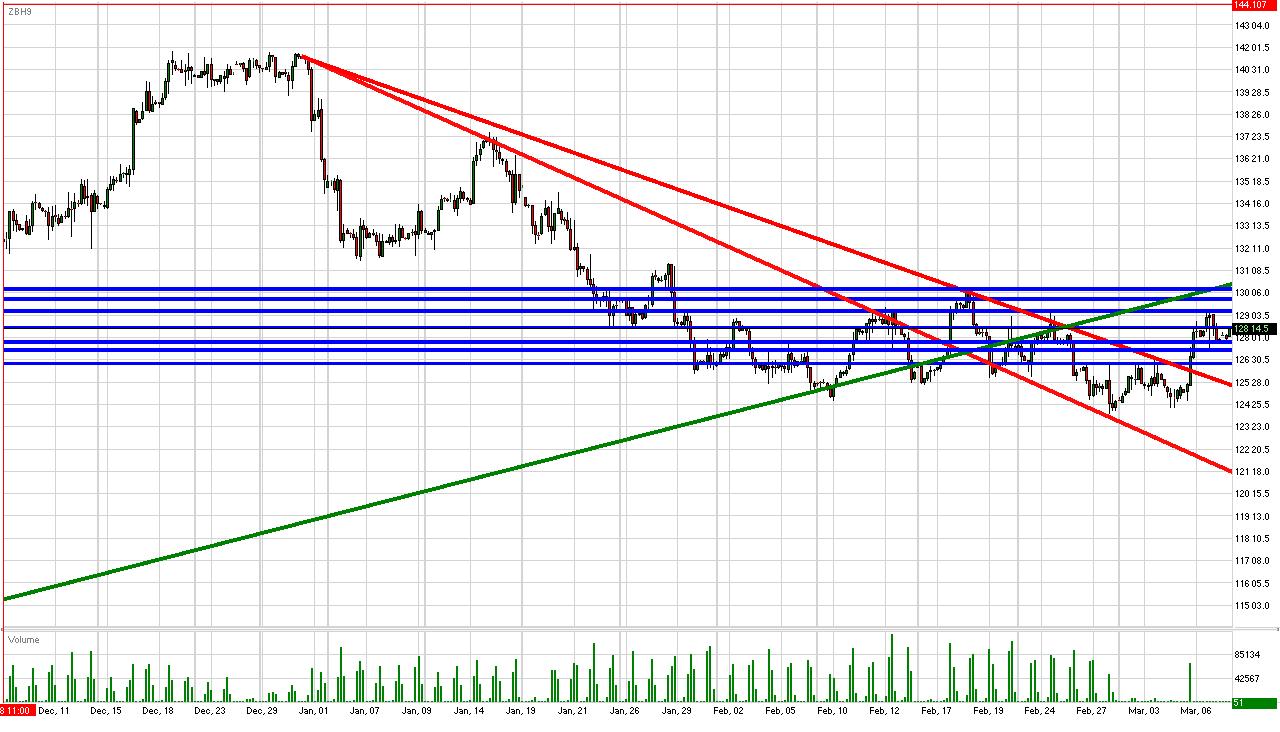

T-Bond Daily Commentary for 3.9.09

The 30 Year T-Bond futures sold off on Friday as U.S. equities posted a late day rally. However, it appears Friday’s downturn was merely profit taking.

The 30 Year futures found support on our 127.8125 level and are edging up Monday with the S&P futures looking to close lower. While the 30 Year futures are wedged between our uptrend and 2nd tier downtrend lines, they could be choosing the upside with no bottom in sight yet for U.S. equities.

If the 30 Year futures can rise above February highs, then we anticipate strong near-term gains. Meanwhile, the futures have built a solid base from the trading range over the past 5 weeks. Therefore, the 30 Year futures have some reliable support if things should turn south. Fundamentally, our 128.5156 support becomes resistance while we maintain our additional resistances of 129.3125, 129.891, and 130.375.

To the downside, we hold our supports of 127.8125 and 127.4219 with fresh bottom-end support of 126.7813. The 30 Year Treasury Bond futures are currently trading at 128 14.5.

Copyright 2009 FastBrokers, Latest Forex News and Analysis for Forex, Bullion and Commodity Traders.

Disclaimer: For information purposes only. FastBrokers assumes no responsibility or liability from gains or losses incurred by the information herein contained. There is a substantial risk of loss in trading futures and foreign exchange.