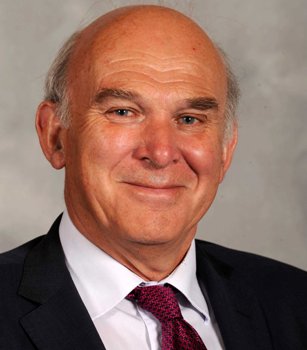

RBS to remain state-controlled for the next five years, Cable

British business minister Vince Cable has indicated that the UK government might not sell its stake in the Royal Bank of Scotland until the next UK general election indicating that the bank will remain with state-controlled for another five years.

British business minister Vince Cable has indicated that the UK government might not sell its stake in the Royal Bank of Scotland until the next UK general election indicating that the bank will remain with state-controlled for another five years.

According to reports, the government might be planning to split the bank into separate entities before selling its stake. Media reports also indicate that it is very unlikely that the government will sell any stake in the bank before the next general election in the UK. Cable said that it is believed that the government might hold its 81 per cent stake in the banking group during the next parliament.

Chancellor George Osborne said that the government is aiming to break up the Royal Bank of Scotland into separate entities. The government has an 82 per cent stake in the Royal Bank of Scotland and indicated that the bank might be split into a good bank and a bad bank with troubled assets. The bank had recorded a profit but was facing high level of toxic assets and the government officials have been looking for ways to revive the bank.

Independent investors have expressed their concerns over the plans to break up the Royal Bank of Scotland to the chairman Sir Philip Hampton. Sir Hampton has said that only independent minority shareholders will be able to vote on plans to split the bank into separate entities.