HDFC Life Insurance Company Ltd. delivered a steady yet unspectacular earnings performance in Q3FY26, marked by resilient premium growth, stable margins, and strong balance-sheet fundamentals.

News in Focus

Maruti Suzuki Ltd delivered a mixed but strategically resilient Q3FY26 performance, as export strength and a GST-led domestic recovery offset near-term margin pressures.

Axis Securities has reaffirmed its BUY recommendation on SBI Life Insurance, upgrading its target price to Rs 2,450 following a strong Q3FY26 earnings performance that exceeded expectations across

Wordle puzzle No. 1,686, released on January 30, offered solvers a deceptively simple challenge that underscored the growing importance of letter-frequency awareness and disciplined deduction.

Geojit Investments has reiterated a HOLD rating on HCL Technologies Ltd, citing strong AI-led deal momentum and resilient engineering services growth, tempered by margin pressures and moderated ear

Axis Securities has reiterated a BUY call on TVS Motor Company, raising its target price to Rs 4,165, following a strong Q3FY26 operational performance marked by robust export growth and accelerati

Main Regional Stories

Gold and Silver prices have been rising over the last few months with the rise being close to madness during January 2026. As the world has witnessed uncertainty and geopolitical risks, buying in safe-haven assets has gone up.

Tata Consumer Products Limited (TCPL) entered the second half of FY26 with renewed operational momentum, delivering a quarter marked by robust volume growth, expanding margins, and improving profitability across its core and emerging businesses.

Multi Commodity Exchange of India (MCX) delivered an exceptional Q3FY26 performance, underpinned by a surge in commodity market volatility, particularly in precious metals.

Markets were almost prepared for no rate cut in today's US Federal Reserve rate announcement and there was a muted reaction from Nasdaq, Dow Jones Industrial Average and S&P.

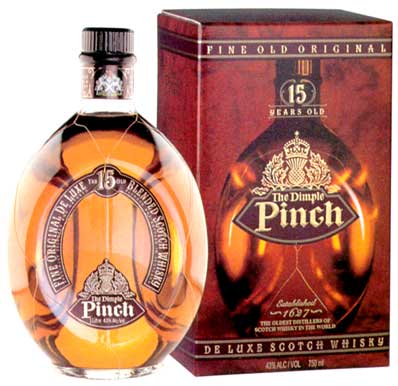

London, Dec 31: The sales of Scotch such as "Glen Highland Green" and "Red Sco

London, Dec 31: The sales of Scotch such as "Glen Highland Green" and "Red Sco Srinagar, Dec 31: Lack of snowfall in Srinagar has dampened the sp

Srinagar, Dec 31: Lack of snowfall in Srinagar has dampened the sp Washington, Dec 31: Imagine being paid just for driving a smart car.

Washington, Dec 31: Imagine being paid just for driving a smart car.