HAL(Hindustan Aeronautics Limited) BUSINESS MODEL ; Revenue and Expenses of HAL and how the geopolitics impact the defense business

For any particular country in the world, two things are always considered important for maintaining stability: the economy and national security. National security depends on how well-equipped a country's military is, especially in comparison to its neighbouring countries. It also depends on where the military equipment is sourced from. Any government should ensure military strength and sovereignty by promoting indigenous production, as this can significantly benefit the country's economy.

According to various military experts, India must be prepared for a potential three-front war at any moment. To ensure this readiness, India is focusing its future military spending on being prepared across land, air, and sea. In this context, companies in the defence sector, such as HAL and BEL, are expected to experience significant growth. Additionally, companies involved in naval operations like Mazdock and GRSE business are likely to benefit. These emerging challenges are creating strong opportunities for the future of the defence sector.

HAL is considered India's largest defence company, with a market capitalization of over ₹3,30,000 crore. In the last financial year (FY25), it generated a profit of more than ₹8000 crore.

This makes it interesting to understand how HAL generates its revenue, manages its expenses, and how its overall business model works.

How does HAL make money

Simply put, various companies in the defence sector operate on a straightforward business model: they receive contracts to produce specific equipment, which they then deliver to those contracting parties. Most of the time, defence companies are closely linked and accounted for by the Ministry of Defence, as they are key players who receive funding and contracts. These companies are often more reliable and indigenous to their country.

It is also important to consider the relationship between that country and the global community. If a country has negative relations or is seen as a potential threat by others, those countries are unlikely to sell military equipment to it, fearing it could become a threat in the future. Therefore, the relationships that a defence manufacturer or production company has with other countries are crucial for their business success.

In the case of defence equipment, there are two main ways to generate revenue: first, by selling finished goods, and second, through the sale of services.

Here’s the crucial part — when any defence equipment is purchased for military personnel, it must be kept ready and functional at all times, so it can be used whenever needed. For this reason, ongoing maintenance and service are essential. This is one of the key ways HAL earns revenue through services in addition to selling products.

Moreover, if any upgrades or modifications are made — whether in terms of technology or size — additional services are required. This creates a recurring revenue stream for the company.

The company is manufacturing the following aircraft and engines:

HTT-14 – Basic trainer aircraft

LCA Mk 1A – Light Combat Aircraft

LUH – Light Utility Helicopter

IMRH – Indian Multi-Role Helicopter

Utility maritime helicopter (UH-M)

25kn turbofan engine (HTFE-25)

1200kw Turboshaft engine (HTSE-1200)

Apart from all of these It generates a very good margin for the company because when they sell products, those products require ongoing services. That’s why any company that has previously sold a large number of products and focuses on upgrading and keeping them up to date with modern technology can continue to generate business even from previously sold products.

In the case of HAL, they generated nearly Rs. 13,595 crores from the sale of goods. Additionally, they earned approximately Rs. 14,258 crores from the sale of services. At the same time, they made around Rs. 286 crores from exports, and from those exported products, they also earned Rs. 25.23crore by providing related services.

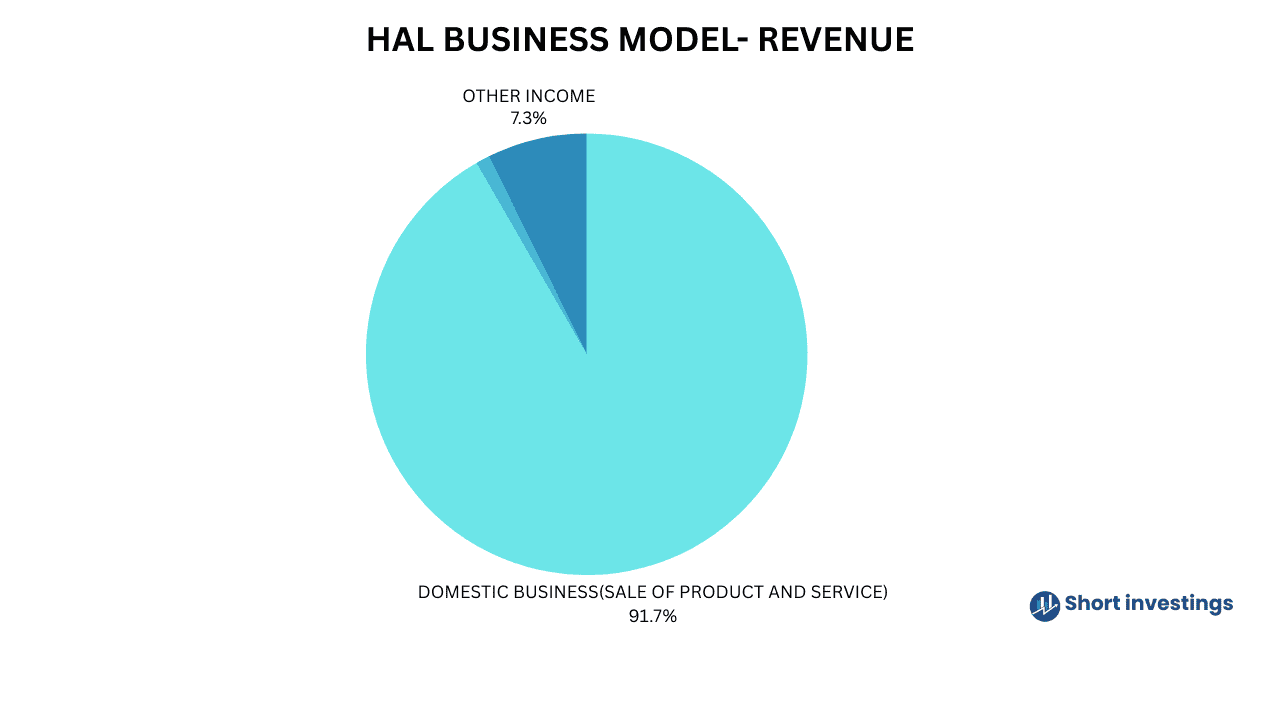

An additional revenue also came from other operating income, such as the disposal of scrap and surplus, provisions no longer required, income from overseas operations, and other sources. In total, they contributed nearly Rs. 2,219 crores under the "Other Income" category.

How does HAL incur expenses

The company had an operating profit margin of nearly 23% in 2020, which increased significantly to around 32% in the financial year 2024. This indicates that while the company’s revenue increased, its expenses decreased, leading to a higher operating margin.

This reveals an interesting point about how HAL manages its expenses and how they are being controlled effectively.

Simply put, the majority of the company’s business comes from selling goods, which obviously requires materials. As a result, most of the expenses come from the cost of materials consumed, which amounts to Rs. 12,347 crores.

The company also has stock-in-trade purchases amounting to around Rs. 671 crores in expenses. Apart from that, the company has significant employee benefit expenses, which are nearly Rs. 5290 crores. In addition to these, the company’s finance cost is very low, at around Rs. 32 crores, indicating that the company has low debt expenses.

The company owns a large amount of defence equipment, which leads to depreciation expenses of nearly Rs. 1,407 crores. Apart from that, the company also sets aside provisions for future uncertainties to stay secure, amounting to nearly Rs. 3303 crores.

Geopolitics relation impact on HAL business

HAL’s main business model is to secure contracts from countries and deliver products according to their requirements.

If India maintains strong relationships with other countries, and those countries view India as a reliable partner rather than a threat, HAL’s business opportunities will grow. Additionally, India ensures that the countries it sells defence products do not pose a national security concern, allowing it to maintain good relationships and continue selling its products.

For example, India is a major buyer of defence equipment and has strong relations with France and Russia. When India purchases defence products from these countries, it ensures that both France and Russia will never sell similar equipment to nations that pose a national security threat, such as Pakistan. Therefore, they do not sell those products to Pakistan. This is a very important point to understand, especially from HAL’s business perspective when dealing with other countries.

In the case of defence sales, countries like those in South African and South Asian countries could be potential buyers for HAL. It would be difficult for HAL to sell aircraft like Tejas to European or Western countries, as those regions have strong business relations with the USA. Therefore, exporting to Western countries may be challenging for HAL. However, South African and South Asian countries present good opportunities for exports, especially since India already maintains strong relations with both regions.

Future of HAL business – 100 billion defence budgets

HAL is expected to achieve significant growth in the coming years as they are innovating and developing advanced indigenous products. This is important because India aims to reduce dependence on other countries for defence equipment. Additionally, India has strong partnerships with Russia and France, which help drive innovation within the country and support export opportunities to other nations.

An important development is that India is making a strong push for “Make in India” defence products. We are producing highly innovative, modern-generation aircraft and maintaining strong global partnerships with countries, such as BrahMos with Russia and Rafale with France. This represents a significant boost from the “Make in India” perspective.

India is also increasing its defence budget, which recently crossed $85 billion, fuelling growth in the sector. Plans to acquire 4th and more modern generation aircraft and invest in advanced technology present great potential opportunities for HAL, and other related defence manufacturers.

Recently, HAL has made significant progress by producing the Indian-made aircraft, Tejas, which has been delivered to and commissioned by the Indian Air Force. Additionally, various exports are expected, as the Argentine Defence Minister recently visited the HL facilities. Several other countries have also shown interest in HL production and are considering purchasing defence equipment from HL, which strengthens the presence of the Indian defence industry.

The company has achieved a massive order book value, aligning with the 'Make in India' initiative. As of March 31, 2024, the order book stands at approximately ₹94,000 crore.

The company also mentioned in its recent annual report that it has invested nearly 15% of its operating profit in the R&D department. This indicates that the company is highly serious and focused on driving innovation within its products.

In order to boost exports, the company has taken several steps. Recently, it delivered two Hindustan- 228 aircraft to Guyana. Additionally, HAL has established a regional office in Kuala Lumpur, Malaysia. The company also mentioned that it has signed a Letter of Intent with the Ministry of Defence of the Republic of Argentina.

Obstacle the HAL business

Obstacles to the company’s growth should be considered carefully. If you take a deeper look at the factors that could hinder HAL’s ability to achieve even higher growth, one major concern arises: the majority of HAL’s business comes from indigenous orders within India. This reliance means the company is heavily dependent on key government ministries Defence for contracts.

HAL manufactures aircraft with numerous variants, unlike countries like the US, Russia, and even China, where standardization is more common. This lack of uniformity can be a disadvantage from a global perspective, as it limits technological advancement and efficiency. As a result, it may become increasingly challenging for HAL to stay competitive and achieve future growth for exporting the business.