Indian Online Sports Betting Grows Faster During Major Events like IPL; Dafatbet, 1XBet, Parimatch, BC.Game Increase Market Share

The Indian sports betting ecosystem is a paradox in motion—hyperactive, lucrative, and yet largely unsanctioned under federal law. A constellation of international brands has carved out deep roots in the subcontinent’s wagering culture, capitalizing on legal ambiguity, cricket mania, and skyrocketing smartphone usage. While Indian regulators continue debating the contours of legality, dozens of offshore operators rake in billions by appealing to local preferences, offering rupee-based bets, and camouflaging their presence via surrogate advertising.

The Foreign Invasion: European and Asian Giants Lead the Game

The Indian market is being led overwhelmingly by brands registered in offshore jurisdictions such as Cyprus, Curacao, Isle of Man, and Malta. These countries offer tax benefits and flexible licensing frameworks, enabling platforms to tap into India’s massive user base while operating beyond the country’s enforcement radar.

Brands like 1xBet (Cyprus/Russia), Parimatch (Cyprus), Betwinner, Melbet, and 22Bet—all rooted in European financial havens—have aggressively customized their interfaces and marketing for Indian users since 2016. Asian conglomerates aren’t far behind, with platforms such as Dafabet and Fun88, both run by Philippines- and UK-licensed entities, cementing their share by riding the wave of cricket-centric promotions.

Crypto Platforms Are the New Disruptors

The 2022–2024 period has seen the rise of crypto-powered betting platforms such as Stake.com and BC.Game. These brands have rapidly scaled up in India thanks to their anonymity, borderless transactions, and generous sign-up bonuses. Their blockchain foundations allow them to circumvent conventional financial systems, drawing in younger, tech-savvy audiences.

Stake.com alone, a recent entrant, reportedly processed over Rs 830 crore (approx. $100 million) in wagers during just one IPL season.

A Timeline of Market Penetration

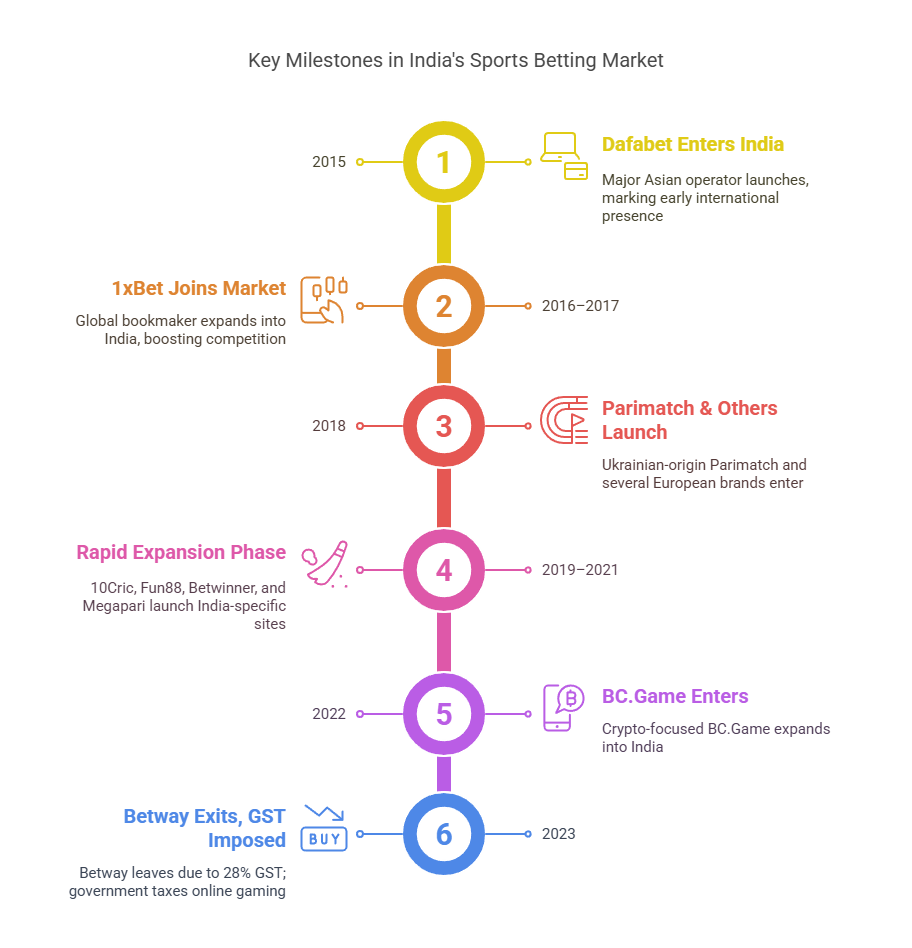

The Indian betting landscape evolved in waves:

- 2015–2018: Early entrants like Dafabet and Parimatch began targeting Indian users as mobile data usage surged.

- 2019–2021: Rapid expansion. New platforms such as 10Cric and Fun88 launched cricket-heavy, India-specific websites.

- 2022–2024: A crypto-fueled arms race began, ushering in brands like BC.Game and Megapari, which prioritized crypto deposits and rapid registration processes.

Local Touchpoints, Global Backbones

Though foreign-owned, these platforms behave like Indian start-ups in disguise. They offer UPI and Paytm payment options, cricket-focused odds, and Hindi-language interfaces. Offshore call centers provide "local" customer support, further blurring the line between foreign and domestic.

Only a handful of Indian-origin platforms exist, and those, like Dream11, operate under a fantasy sports model that skirts anti-gambling laws by claiming "game of skill" exemptions.

Legal Ambiguity: The Elephant in the Room

India's sports betting market exists in a legal gray zone. The Constitution of India classifies gambling as a state subject, leaving each state to set its own policies. While states like Telangana and Tamil Nadu have banned all forms of online gambling, others offer lotteries and permit horse race betting.

The central legal framework—the Public Gambling Act of 1867—is hopelessly outdated, predating not just the internet, but even India’s independence. This legal vacuum has enabled the proliferation of online betting platforms, many of which technically operate outside Indian jurisdiction.

Regulatory Hesitations and the GST Fallout

The Indian government’s most aggressive move thus far was the imposition of a 28% Goods and Services Tax (GST) on betting platforms in 2023. The result? Leading operator Betway, owned by the UK-based Super Group, exited the Indian market citing high compliance costs.

Despite this, enforcement remains lax. Offshore operators simply rebrand, change domain names, or run surrogate ads under the guise of "news" or "fantasy sports" portals.

Advertising Loopholes: Surrogacy and Sponsorship

Surrogate advertising has become a tool of choice for these firms. Operators often promote affiliated sports news websites or gaming apps that carry identical branding and logos to their parent betting platforms. These sites act as fronts for redirecting traffic to the actual betting portals.

Some even sponsor IPL teams or international sports events, often with thinly veiled branding, further complicating enforcement.

Why Indians Bet: A Cultural and Technological Storm

India’s love for betting isn’t new—it’s ancient. But the explosion in smartphone usage, fast data, and digital wallets has supercharged access.

- Cricket Fever: The IPL serves as a catalyst, with millions placed on outcomes ranging from match winners to number of sixes.

- Ease of Access: Platforms offer seamless logins, cashouts via Paytm, and even crypto integration.

- Lack of Domestic Alternatives: In the absence of local legal betting frameworks, users gravitate toward foreign sites.

Challenges in Enforcement and the Regulatory Tug-of-War

The government has started taking steps, notably assigning the Ministry of Electronics and Information Technology (MeitY) to oversee online gaming. However, this body has stopped short of offering a concrete regulatory regime. Instead, it has issued loose guidelines around advertising and user safety.

Key reasons for the lack of firm legislation:

- Federal deadlock: States can’t reach consensus on a unified law.

- Political risk: The sector generates significant revenue and employment, making bans a hot potato.

- Surveillance complexity: Offshore platforms are difficult to trace and block effectively.

The Scale of the Market

Current estimates suggest tens of millions of Indians bet regularly online, with monthly traffic from India reaching hundreds of millions across major platforms.

Valuation figures include:

- The legal skill-gaming market: Estimated at $4 billion.

- The grey/illegal betting market: Believed to be **several times larger**.

- IPL-season surge: Stake.com alone saw bets worth **over Rs 830 crore** during a single tournament.

Conclusion: The Path Forward Remains Murky

India’s sports betting industry continues to flourish in a shadowy twilight of legality. Despite warnings from regulators and sporadic state crackdowns, international operators—especially from Europe and Asia—remain deeply embedded, adapting faster than legislators can regulate.

Key takeaway: Without a unified federal approach, the Indian sports betting landscape will remain fragmented and foreign-dominated, with users caught in a legal limbo and billions flowing offshore.