Crude Daily Commentary for 4.8.09

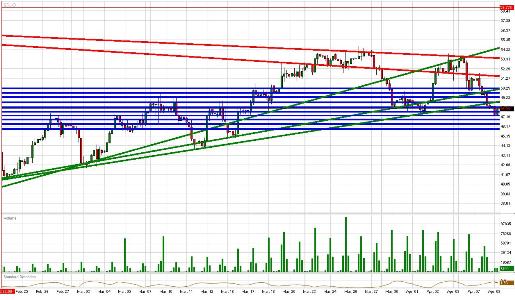

The battle back to $50/bbl never materialized yesterday and crude futures continued to freefall from our 1st tie uptrend line. Though we don't want to be premature, it seems the backbone of the uptrend has been broken. Now, we could always see a strong rally today to get the futures back above our 1st tier uptrend line.

However, our point of no return uptrend line is looking down at price. This is a strong statement, and crude futures could be in for even more large losses before they stabilize. The futures are holding onto April lows for dear life, and if these don't hold, look out below.

The U. S. will release weekly inventory data today and the number has come in above analyst expectations the last four weeks. Another rise in inventories could force investors to pause and question whether the OPEC production cuts are actually having their desired impact on supply.

Today's inventory release aside, crude futures should continue to follow their tight correlation with U. S. equities for the time being. Therefore, the negative fundamental developments in crude raise a cautionary flag concerning the ability of the S&P futures to hold 800.

Fundamentally, we find resistances of $48.21/bbl, $48.74/bbl, $49.28/bbl, $49.72/bbl, and $50.20/bbl. To the downside, we see supports of $47.72/bbl, $47.32/bbl, $46.89/bbl, $46.42/bbl, and $45.92/bbl. Crude futures are presently trading at $48.04/bbl.

Copyright 2009 FastBrokers, Latest Forex News and Analysis for Forex, Bullion and Commodity Traders.

Disclaimer: For information purposes only. FastBrokers assumes no responsibility or liability from gains or losses incurred by the information herein contained. There is a substantial risk of loss in trading futures and foreign exchange.