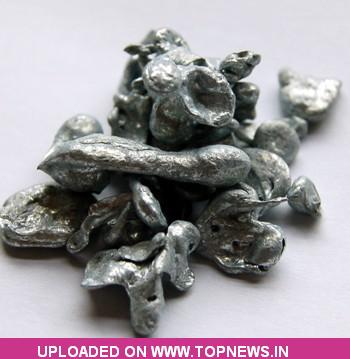

Commodity Trading Tips for Zinc by KediaCommodity

Zinc settled 1.21% up at 103.40 as markets still focused on weak global PMI data and expected central banks would introduce additional economic stimulus. Several European countries issued bonds wildly ahead of the ECB meeting, but German finance minister warned that markets should not expect too much from the ECB, which have not intervened in bond markets for 25 weeks. Besides, as US equity markets were closed for Labor Day, LME market activity was relatively muted. Moody's announced to place the EU's 3A credit rating to negative, while Spain's Andalusia region requested EUR 1 billion rescue funds from the government, which will weigh prices down. LME base metal prices rallied overnight and were poised to rise further. The price increase was mainly higher expectation over QE3 on Bernanke’s remark at the central bank meeting. Meanwhile, the ECB Governing Council member Asmussen stated that the ECB Governing Council would discuss debt purchase at September meeting. Close attention should be paid to interest rate meeting result from the ECB and other major central banks and the US nonfarm employment data due on Friday, which will affect base metal prices. For today's session market is looking to take support at 102.5, a break below could see a test of 101.6 and where as resistance is now likely to be seen at 104, a move above could see prices testing 104.7.

Zinc settled 1.21% up at 103.40 as markets still focused on weak global PMI data and expected central banks would introduce additional economic stimulus. Several European countries issued bonds wildly ahead of the ECB meeting, but German finance minister warned that markets should not expect too much from the ECB, which have not intervened in bond markets for 25 weeks. Besides, as US equity markets were closed for Labor Day, LME market activity was relatively muted. Moody's announced to place the EU's 3A credit rating to negative, while Spain's Andalusia region requested EUR 1 billion rescue funds from the government, which will weigh prices down. LME base metal prices rallied overnight and were poised to rise further. The price increase was mainly higher expectation over QE3 on Bernanke’s remark at the central bank meeting. Meanwhile, the ECB Governing Council member Asmussen stated that the ECB Governing Council would discuss debt purchase at September meeting. Close attention should be paid to interest rate meeting result from the ECB and other major central banks and the US nonfarm employment data due on Friday, which will affect base metal prices. For today's session market is looking to take support at 102.5, a break below could see a test of 101.6 and where as resistance is now likely to be seen at 104, a move above could see prices testing 104.7.

Trading Ideas:

Zinc trading range for the day is 101.57-104.67.

Zinc settled up as market expectations over the introduction of QE3 by the Federal Reserve supported prices

Purchases of short term sovereign bonds by the European Central bank would not breach European Union rules

Moody's Investors Service has changed its outlook on the Aaa rating of the European Union to negative