BHEL Share Price Declines 3.56 Percent in an Overall Weak Market

BHEL share price declined 3.56 percent in today's session as majority of public sector stocks were facing selling pressure today. BHEL opened the trading session at Rs 217 but soon drifted to Rs 208.8. The stock closed at Rs 209.2 and the stock is currently close to its 52-week lows.

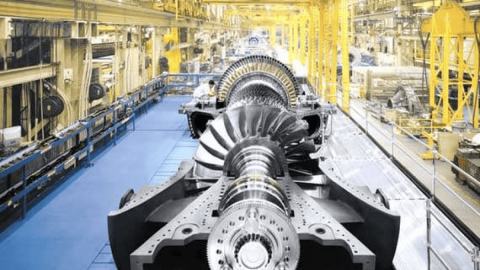

Bharat Heavy Electricals Limited (BHEL), a leading public sector enterprise in the power and engineering sectors, has been at the forefront of India's industrial development. Currently trading between Rs. 208.80 and Rs. 218.24, the stock has a market capitalization of Rs. 72,940 crore. While its P/E ratio of 312.24 suggests high valuation, its 52-week range from Rs. 191.66 to Rs. 335.35 reflects considerable volatility. TopNews delves into the stock’s technical patterns, Fibonacci retracement levels, and support/resistance analysis, alongside a comparison with sectoral competitors such as Larsen & Toubro (L&T) and NTPC Limited.

BHEL: Key Performance Metrics

| Metric | Value |

|---|---|

| Current Price Range | Rs. 208.80 - Rs. 218.24 |

| Market Cap | Rs. 72,940 crore |

| Price-to-Earnings (P/E) Ratio | 312.24 |

| Dividend Yield | 0.12% |

| 52-Week High | Rs. 335.35 |

| 52-Week Low | Rs. 191.66 |

Technical Analysis: Candlestick Patterns

The daily candlestick for BHEL exhibits a **Doji pattern**, characterized by near-equal open and close prices. This pattern typically signals market indecision and may precede a major price move. Given the proximity to key support levels, the stock could be at a crossroads, warranting close monitoring in the coming sessions.

Fibonacci Retracement Levels

Using BHEL’s 52-week high of Rs. 335.35 and 52-week low of Rs. 191.66, the Fibonacci levels are as follows:

| Level | Price |

|---|---|

| 0% (52-week low) | Rs. 191.66 |

| 23.6% | Rs. 228.82 |

| 38.2% | Rs. 252.67 |

| 50% | Rs. 263.51 |

| 61.8% | Rs. 274.35 |

| 100% (52-week high) | Rs. 335.35 |

Key Insight:

The stock is currently trading below the 23.6% retracement level (Rs. 228.82). A move above this level could indicate bullish momentum, while a drop below Rs. 191.66 (0% level) would signify further weakness.

Competitor Analysis

Larsen & Toubro (L&T)

Market Cap: Rs. 4.1 lakh crore

P/E Ratio: 35.23

Dividend Yield: 1.25%

NTPC Limited

Market Cap: Rs. 2.07 lakh crore

P/E Ratio: 9.48

Dividend Yield: 4.44%