Base Metals Trading Strategy and Commodity Market Update: Nirmal Bang

Base Metals floated higher with the equities markets and mostly ended higher than their previous close. Three month LME Copper rose by $150 to end at $4470 and the three month LME Nickel rose by $475 to finish the day at $1150.

Base Metals floated higher with the equities markets and mostly ended higher than their previous close. Three month LME Copper rose by $150 to end at $4470 and the three month LME Nickel rose by $475 to finish the day at $1150.

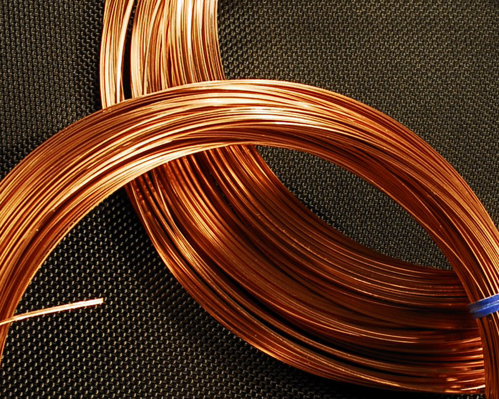

Copper futures edged higher on Fridaytracking a fall in LME inventories. Copper stocks on the LME fell by 10,925 tonnes to 429,500 tonnes. Some traders are of the view that China's State Reserves Bureau (SRB), which bought 350,000 tonnes of copper cathode in the first quarter of 2009, could sell around 50,000 tonnes of copper to cash in on recent rallies.

Brazils’ mining Giant Vale has announced plans to further trim its nickel output this year. It is shutting down its mines, mills and smelter in Sudbury for eight weeks beginning on June 1, 2009. The shutdown follows a normal onemonth maintenance period in May. It has also postponed the start up of the Onça Puma project in Brazil for a year or more, at least to January 2011.

Base Metals may trade soft during morning session but we don’t remain very bearish on them. We may see base metals prices edging up during later part of the session. We recommend buying copper and nickel at dip of 1-2%.

Copper, after a sharp correction, has bounced back on Friday and the trend doesn’t look very bullish as ADX is suggesting that it is still not very strong. We believe, buying at dips is a good strategy as good support is pegged at Rs 216.8.

Technically, zinc doesn’t look very bullish. On the downside, first target is 68.6 and breaching that it might test a level of 66 on MCX. We recommend selling on rise in zinc rather than buying. Prices may move down during the day.

In Nickel, maximum upside during the intraday session could be Rs. 586. We recommend to book profits on long positions between RS. 580-586. Once price touches these levels, selling pressure is likely to come.