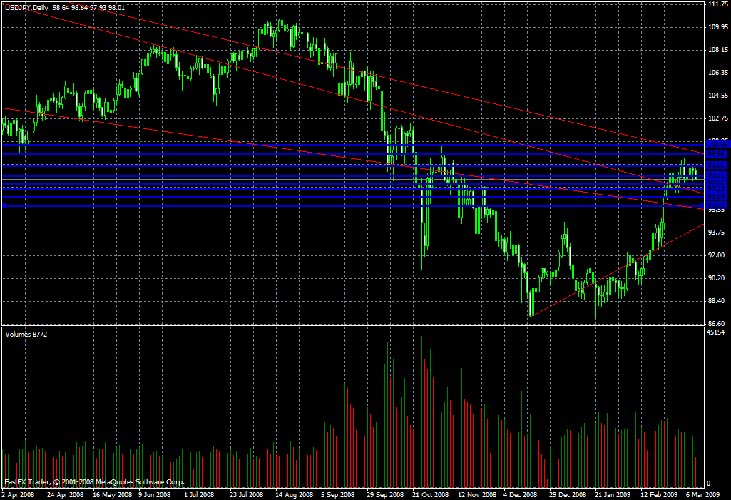

USD/JPY Daily Commentary for 3.11.09

The USD/JPY confirms the lack of FX investor excitement concerning the massive rally on Wall Street. The USD/JPY moved sideways showing indifference to a surging S&P.

Even though Japan’s Core Machinery Orders experienced a hefty decline, the number came in better than analyst expectations. Therefore, investors are questioning whether the Japanese or U. S. economy is performing better right now. If Japanese data continues to beat expectations while U. S. disappoints, then we could witness a return to the negative correlation between the USD/JPY and S&P futures.

It seems the USD/JPY has cooled off for now, and may experience a little profit taking as the currency pair builds a new base before deciding upon its next move. Meanwhile, the 3rd tier downtrend line is bearing down on the USD/JPY with the highly psychological 100 level lurking in the distance. Investors are highly anticipating Japan’s Final GDP release hitting the news wire tonight.

Fundamentally, our 98.25 support turns resistance while we hold our additional resistances of 99.05, 99.96, and 100.69. To the downside, we maintain our supports of 97.66, 97.22, and 96.59 with fresh bottom-end support of 95.92. The USD/JPY is currently exchanging at 98.01.

Copyright 2009 FastBrokers, Latest Forex News and Analysis for Forex, Bullion and Commodity Traders.

Disclaimer: For information purposes only. FastBrokers assumes no responsibility or liability from gains or losses incurred by the information herein contained. There is a substantial risk of loss in trading futures and foreign exchange.