Octa Trading Review 2024: All Pros & Cons

Octa (formerly OctaFX), a prominent online trading platform, is known for its versatile offerings and user-friendly interface. Catering to both beginners and experienced traders, it provides competitive spreads, diverse trading instruments, and an easy-to-navigate app.

Octa: Company Overview

Octa (OctaFX) is a global forex and CFD trading platform that has gained widespread popularity, including among Indian traders, due to its user-friendly interface and attractive trading conditions. Founded in 2011, Octa provides a wide range of trading options, including forex, commodities, indices, and cryptocurrencies.

With commission-free access to financial markets, Octa has attracted clients from over 180 countries and boasts more than 42 million trading accounts. The platform has received more than 70 industry awards, reflecting its commitment to excellence in service. It was recognised as the ‘Best Forex Broker India’ in 2020, 2021, and 2022, as well as the ‘Best Online Broker Global 2022’ by the World Business Outlook.

In India, Octa is especially appealing due to its competitive spreads, low initial deposit requirements, and multiple account types suited for both beginners and experienced traders. The broker has established itself as a reliable choice within India’s growing online trading market, though users should be mindful of the lack of local regulatory oversight.

Octa: Products & Services

Octa trading offers a broad range of products and services, catering to diverse trading needs. Key offerings include forex, where users can trade major, minor, and exotic currency pairs with competitive spreads. The platform further supports access to indices, cryptocurrencies, and more, allowing traders to diversify their portfolios.

Additionally, Octa supports CFD (Contract for Difference) trading on global indices and cryptocurrencies, such as Bitcoin, Ethereum, and more, which offers an opportunity to trade market volatility without owning the underlying assets.

For more convenience, Octa offers a range of account types to suit different trading needs, including standard accounts with fixed or floating spreads, and ECN accounts with market execution and tight spreads.

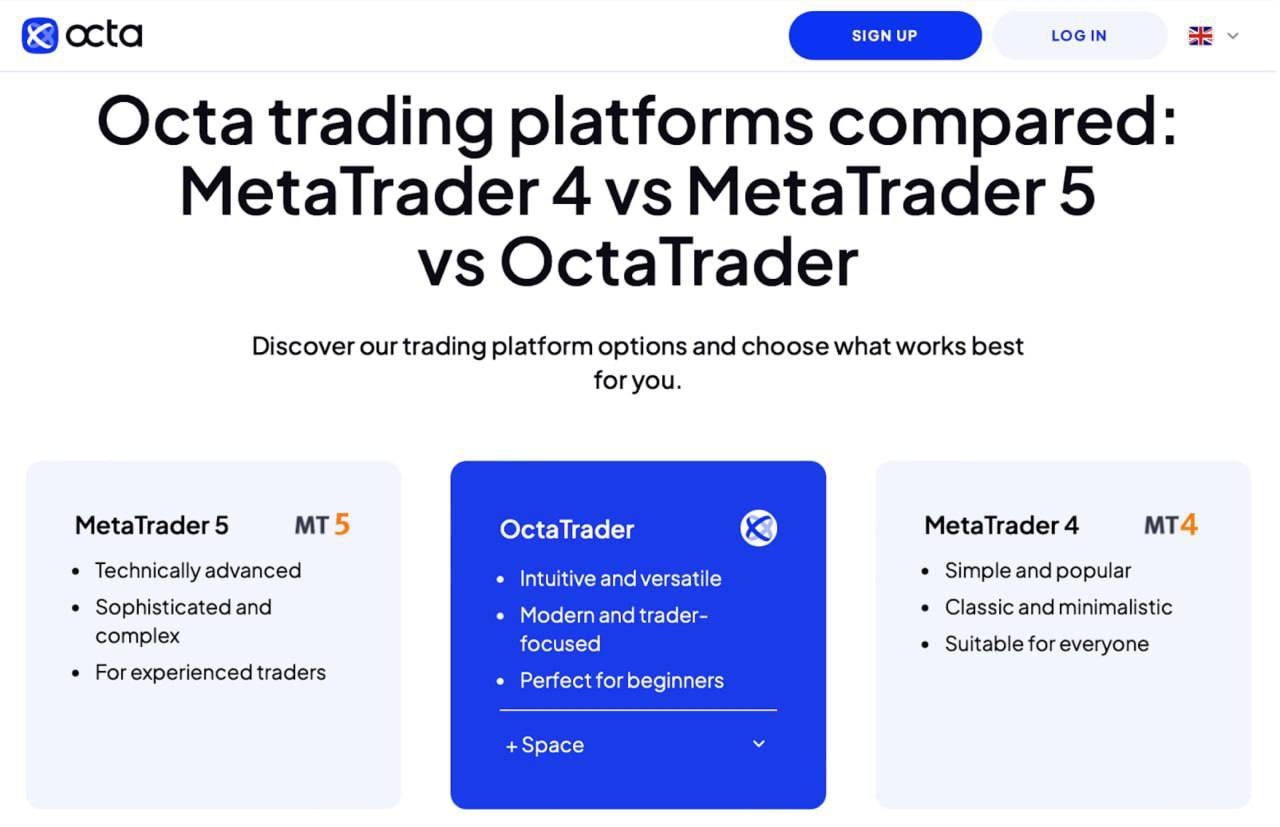

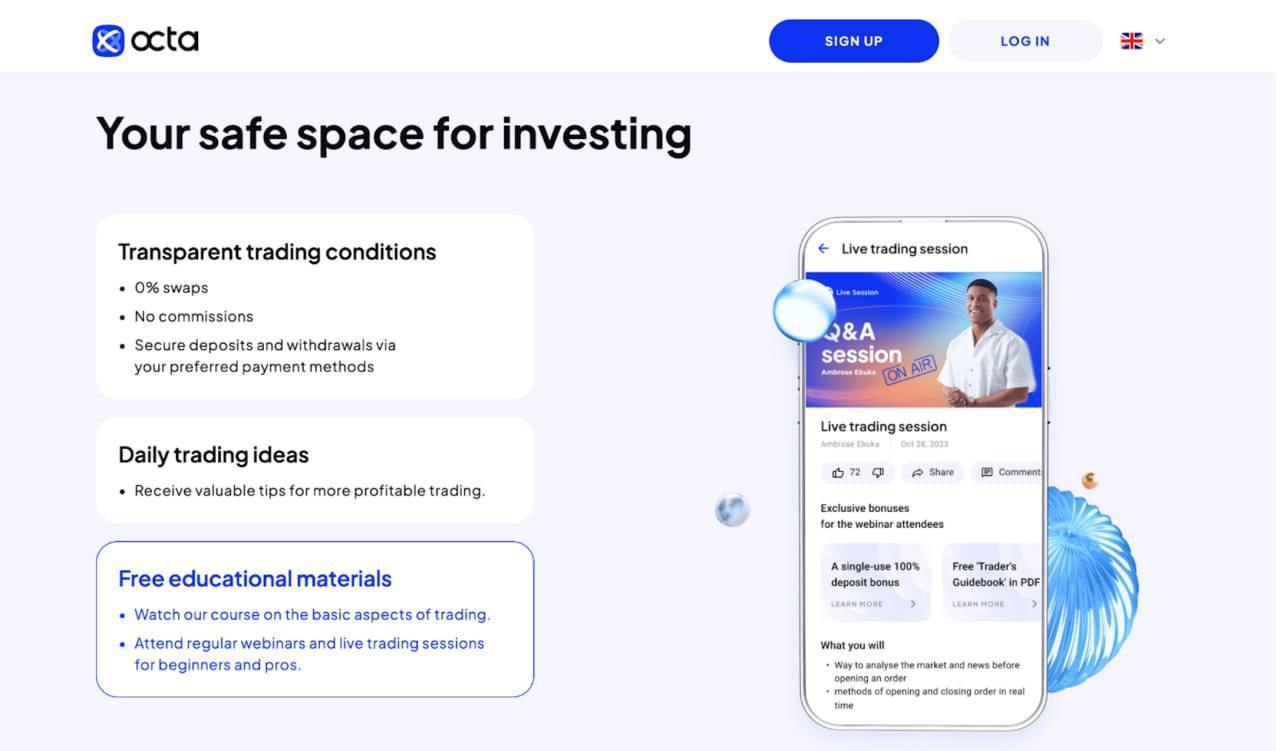

Octa provides several trading platform options, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its own OctaTrader platform. In OctaTrader, users can find an integrated feature called Space — a unique live feed designed to offer trading insights in real time and market trends analysis by Octa’s experts. Users can also execute orders directly within the platform.

Octa further enriches the trading experience with a suite of educational resources and powerful trading tools, including copy trading and technical analysis indicators, which serve both novice and experienced traders alike.

Is Octa legal in India?

Octa (formerly OctaFX) is legally accessible to Indian traders, though it’s essential to understand the regulatory landscape. Octa operates as an international broker, yet it is not directly regulated by Indian financial authorities, such as the Securities and Exchange Board of India (SEBI). This lack of local regulation is common across the industry, as the decentralised and complex nature of the global forex market makes adhering to every country’s specific requirements challenging. Many international brokers, including Octa, opt out of obtaining local licences to maintain consistent trading conditions globally, which allows them to offer competitive terms without direct regulatory recognition in India.

To ensure a secure trading environment, Octa operates under established international regulatory frameworks, including oversight from the Cyprus Securities and Exchange Commission (CySEC) and the Financial Sector Conduct Authority (FSCA) in South Africa, both well-regarded for their regulatory standards.

Using an internationally regulated platform offers unique advantages, but staying informed about Indian financial regulations is always wise. Indian traders can freely use the platform while keeping up with relevant financial guidelines within the country. For responsible trading, it’s advisable to be aware of local tax laws and compliance requirements. Additionally, consulting a financial advisor can support informed decision-making and help clarify any specific considerations for trading in a global market.

Pros and cons of trading with Octa in India

When considering trading with Octa, it's important to weigh both the pros and cons.

Pros include strong regulation in multiple jurisdictions, which adds a layer of security, and the availability of high leverage options that allow traders to maximise their potential gains. The platform also offers a diverse range of assets, including forex and cryptocurrencies, along with a user-friendly interface that appeals to both beginners and experienced traders alike. Additionally, Octa trading provides valuable educational resources and often runs promotions that can benefit traders.

On the downside, the platform’s lack of specific regulation from Indian authorities may be a concern for some users. It also offers a limited selection of tradable symbols (up to 230) and restricted support for high-frequency trading, which may not meet the needs of very active traders. At times, customer service can be slow, and there is no direct phone line or VIP discount program, which could be a drawback for those seeking more personalised assistance.

| Pros | Cons |

|---|---|

| Regulation in multiple jurisdictions | No local regulation specifically in India |

| High leverage options | Narrow selection of tradable symbols |

| Diverse asset range (forex, commodities, cryptocurrencies) | Limited HFT trading (30 requests per minute) |

| User-friendly trading platform and mobile app | No phone support |

| Educational resources (tutorials, webinars) | Some reports of slow customer support |

| Promotions and bonuses for traders | No VIP discounts |

Octa Reviews: What customers are saying about the platform?

With an average score of 4,4 of 5 on Trustpilot, Octa belongs to the highly-rated broker services. Many appreciate the user-friendly design of the trading platform and mobile app, noting that it is intuitive and easy to navigate.

Users also highlight the educational resources available, which help them learn trading strategies and improve their skills. Some reviews mention positive experiences with customer support, citing responsiveness and helpfulness.

On the other hand, several users raise concerns about the withdrawal process, reporting delays in accessing their funds. Some mention that spreads can widen during periods of high market volatility, which may increase trading costs.

Conclusion: Trading with Octa is worth it

When considering Octa trading, it's important for individuals to carefully evaluate their own trading goals and risk tolerance, and to conduct thorough research into the platform's features, regulations, and customer reviews before making a decision.

The platform is valuable for beginners thanks to its intuitive interface and educational resources, as well as for advanced traders seeking commission-free trading and leverage ratios up to 1:1000.