Mahindra Lifespace Developers has reached a long-awaited inflection point.

News in Focus

BOB Capital Markets Ltd has reiterated its BUY call on Adani Ports and Special Economic Zone Ltd, setting a target price of Rs 1,960, implying an upside of nearly 28% from current levels.

Power Grid Corporation of India, the country’s dominant power transmission utility, is entering a structurally stronger execution phase after several quarters of muted performance.

Bajaj Finance’s Q3FY26 performance reflects a deliberate trade-off between short-term profitability and long-term balance-sheet strength.

Axis Securities has maintained its BUY recommendation on Chalet Hotels Limited with a target price of Rs 1,120, implying a 25% upside from the current market price of Rs 896.

ICICI Securities has reiterated a BUY call on Hyundai Motor India (HMIL), citing resilient execution in Q3FY26 despite near-term margin pressures linked to capacity expansion.

Main Regional Stories

IDBI Capital Markets has reiterated a BUY call on Sundaram Finance Limited, citing consistent execution, resilient asset quality, and improving profitability across cycles.

City Union Bank delivered a mixed but strategically strong Q3FY26 performance, marked by robust loan growth, resilient margins, and steadily improving asset quality.

IDFC First Bank is entering a decisive phase of operational maturity as margin expansion, disciplined balance-sheet growth, and easing asset-quality pressures converge.

Greenlam Industries is entering a critical inflection phase after a seasonally weak third quarter, with management signaling a sharp rebound in volumes, operating leverage, and profitability from Q4FY26 onward.

Despite a rally in the value of euro on Friday, the rupee weakened. One of the major reasons, say analysts is the increase in demand for US dollar because of rise in defense related payments. It worked as a major denting factor for rupee.

Despite a rally in the value of euro on Friday, the rupee weakened. One of the major reasons, say analysts is the increase in demand for US dollar because of rise in defense related payments. It worked as a major denting factor for rupee. IL&FS Investment Managers, the private equity fund management company listed on the bourses said that it has seen a marginal decline in its net profit for the quarter ending June 30,2010.

IL&FS Investment Managers, the private equity fund management company listed on the bourses said that it has seen a marginal decline in its net profit for the quarter ending June 30,2010.  Lack of any major news allowed Indian equities market to trade within a narrow range only. Nevertheless it carried on the positive trail to end the day in green.

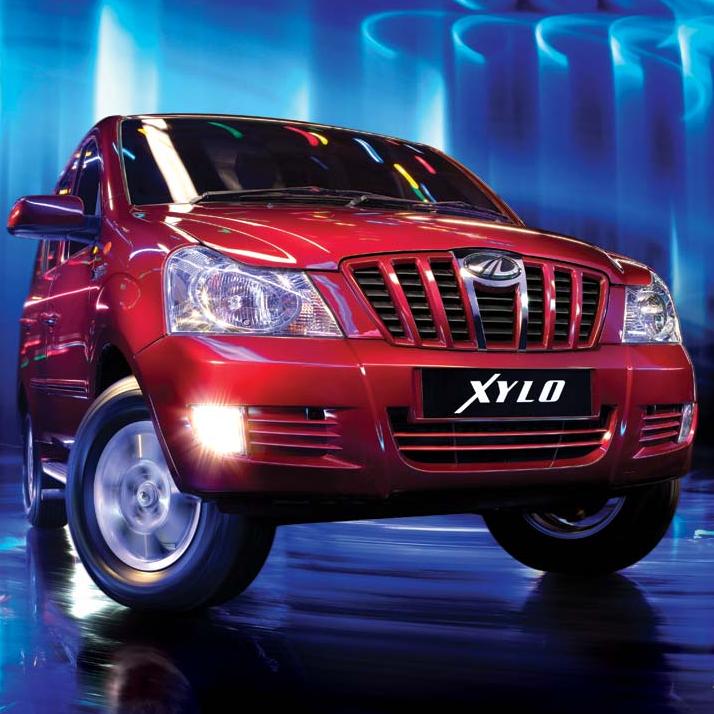

Lack of any major news allowed Indian equities market to trade within a narrow range only. Nevertheless it carried on the positive trail to end the day in green.  On Wednesday, Mahindra & Mahindra (M&M) said that it is planning to roll out a sub Rs. 5 lakh car. This is expected to be a sports-utility vehicle and will come under the brand of Xylo. The information was given by two people familiar with the development.

On Wednesday, Mahindra & Mahindra (M&M) said that it is planning to roll out a sub Rs. 5 lakh car. This is expected to be a sports-utility vehicle and will come under the brand of Xylo. The information was given by two people familiar with the development. Jignesh Shah is not happy with the way market regulator, SEBI has been giving clearances and he was ready to make his feelings public.

Jignesh Shah is not happy with the way market regulator, SEBI has been giving clearances and he was ready to make his feelings public. After Tata Consultancy Services Ltd (TCS) posted a 21 per cent increase in its quarterly profit, the shares of the company rose by 4 per cent on Friday.

After Tata Consultancy Services Ltd (TCS) posted a 21 per cent increase in its quarterly profit, the shares of the company rose by 4 per cent on Friday.