US Congress takes aim at Obama's financial overhaul

Washington - US legislators launched the first salvos Thursday in a looming battle to overhaul the country's means of regulating the financial industry after one of its worst ever crises.

Washington - US legislators launched the first salvos Thursday in a looming battle to overhaul the country's means of regulating the financial industry after one of its worst ever crises.

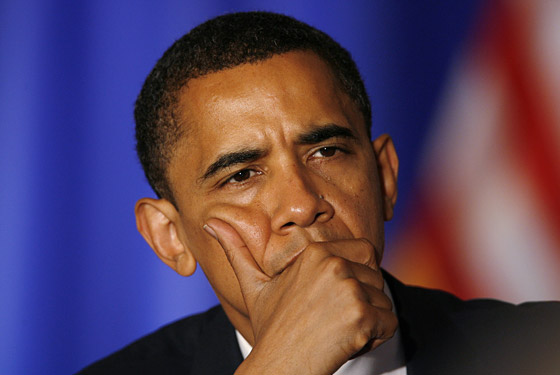

Senators voiced skepticism about President Barack Obama's plan for strengthening the government's oversight of Wall Street, which was billed Wednesday as the most sweeping regulatory reforms since the Great Depression of the 1930s.

Lawmakers took special aim at the Federal Reserve, the US central bank, which could get a new round of powers to monitor the country's top banks.

Senator Christopher Dodd, the Democratic chairman of the committee, questioned the Fed's "track record" after failing to prevent the current financial crisis, which led to the country's longest recession in 70 years.

Senator Richard Shelby, the top Republican on the Senate Banking committee, charged that the Obama administration had a "grossly inflated view of the Fed's expertise."

Treasury Secretary Timothy Geithner, who testified before the committee, argued the Fed was the "best positioned" regulator to take on the role, but acknowledged that the central bank may need to reform its own governing structure to respond faster to the next crisis.

The administration is seeking broad new powers to watch over major US banks, which were brought to the brink of collapse by careless risks in the US housing markets. The Fed lies at the centre of the reform plans, which Obama has said will help prevent another crisis from ever happening again.

"Every financial crisis of the last generation has sparked some effort at reform. But past efforts have begun too late, often after the will to act has subsided," Geithner said. "Our economy was brought too close to the brink for us to let this moment pass." (dpa)