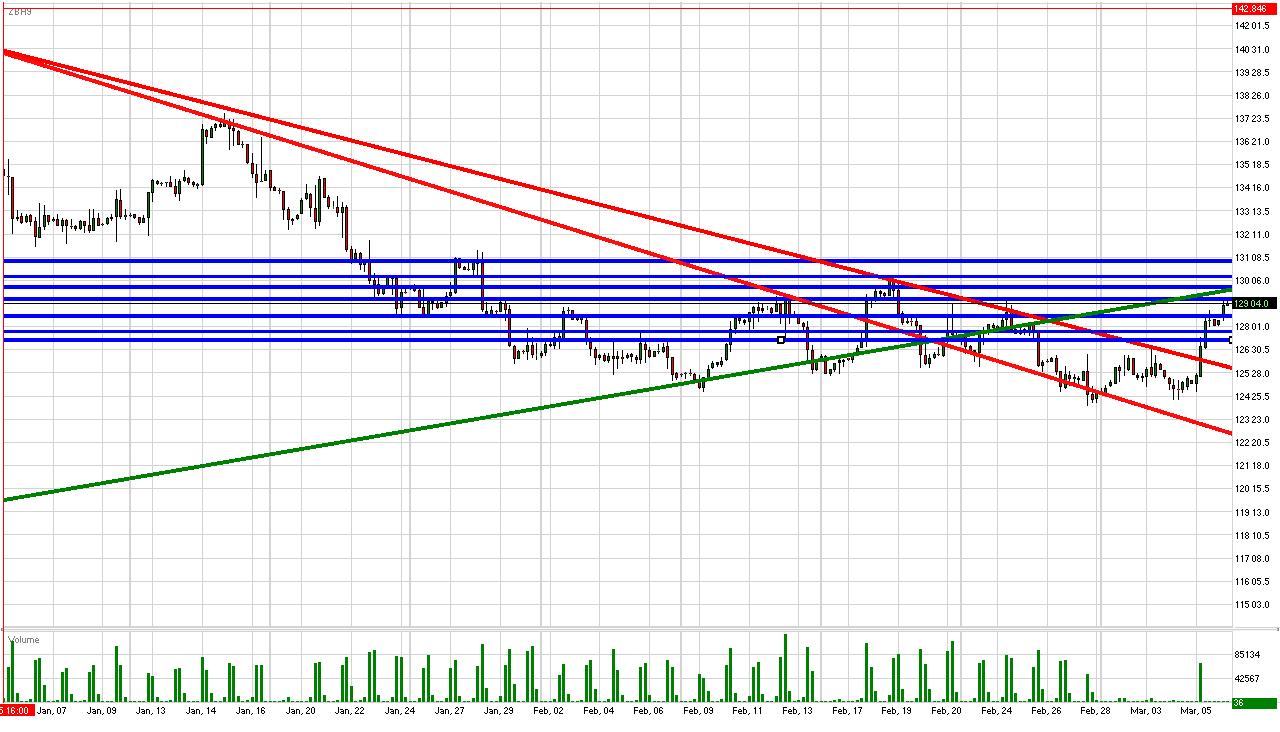

Treasury Bond Daily Commentary for 3.6.09

The 30 Year T-Bond futures surged on Thursday with the S&P futures continuing their freefall.

Despite the rising supply of long-term treasury bonds in order to raise capital for the government's large stimulus plan, the negative correlation between bonds and equities has been reactivated.

The 30 Year T-Bond futures rose well above all of our previous resistances are approaching our uptrend line with the downtrend lines fading into the distance.

We expect the continuation of sizeable near-term gains should the 30 Year futures climb above February highs.

With the U. S. Unemployment Rate on deck and the S&P futures looking to open in the red again, the environment is suitable for a run in the 30 Year T-Bond futures.

Fundamentally, we find fresh resistances of 129.3125, 129.891, 130.375, and 131.109.

To the downside, see supports of 128.5156, 127.8125, and 127.4219.

The 30 Year Treasury Bond futures are currently trading at 129 04.0.

Copyright 2009 FastBrokers, Latest Forex News and Analysis for Forex, Bullion and Commodity Traders.

Disclaimer: For information purposes only. FastBrokers assumes no responsibility or liability from gains or losses incurred by the information herein contained. There is a substantial risk of loss in trading futures and foreign exchange.